Latest News

Exclusive Interview with Andy Jarrett, CEO of Twelve40

We have had an email interview with Andy Jarrett, CEO at Twelve40. He took time to provide some really insightful answers to our questions. He talks about his professional journey to the top of a major company, about the challenges and opportunities he faced during the impressive growth of Twelve40, and the company’s well-thought-out growth strategy.

He also introduces some of the latest offerings from Twelve40 and explains how the company is seamlessly incorporating new technologies into its existing development platform. Read his fascinating answers below.

To begin with, tell us something about yourself and your career. It’s always nice to hear top-class professionals say a few words about themselves for our audience.

Andy: I have spent a great deal of my career in the technology and iGaming sectors, having held senior board positions at both Digital Jersey and Foreshore. Across those positions I have held responsibility for overseeing both product portfolios and strategic growth objectives. I also co-founded a successful big data business that is now headquartered in Scotland, alongside co-founding a fintech business that I have since exited.

My experiences in building both robust and scalable technology and working on a cross-jurisdictional basis have transferred well into the iGaming sector, and I’m looking forward to continuing to grow Twelve40 after a whirlwind first couple of years!

You became the CEO of Twelve40 after its merger with Code Collective about two years ago. Prior to that, Twelve40 became the first to get a remote gambling operator’s license from Jersey. What were your immediate challenges when taking charge of managing employees from two diverse work cultures at a moment of huge responsibility?

Andy: Having successfully undertaken the launch of Jersey’s iGaming proposition through Digital Jersey, the merger of Twelve40 and Code Collective was a crucial milestone in securing Jersey’s digital vision, bringing together an experienced and highly capable team with global export prospects and strong ambition.

There is of course always a challenge when it comes to bringing together two teams of people new to each other following any merger, but it is a hurdle that as a combined business we cleared with ease through our shared desire to deliver the highest quality lottery and iGaming experiences.

In two years’ time, Twelve40 has grown by making a string of integrations like Spiffx, VSoftCo and Wazdan. Can you shed more light on how the integrations have added value to Twelve40?

Andy: We are always looking to add value to the services that we offer to our clients through our platform, and being able to offer the best content across a wide range of verticals is core to that approach. Boosting our sporting profile through integrating Spiffx sports-betting games and VSoftCo virtuals has enhanced our multi-vertical approach, while we were proud to elevate our services by bringing on board Wazdan’s premium collection of top-performing slot titles.

The proposition here is a simple one – the more varied and high-quality content that we can offer to our clients, the more attractive our platform and technology is to potential partners. We have witnessed a great deal of interest in our services resulting from these integrations, and will continue to work with the iGaming’s top-tier providers to find the right products to complement our in-house offering.

One of the remarkable features of Twelve40’s growth has been its solid presence as an online lottery platform and game provider in Africa, Asia and Latin America. Was it a conscious decision to explore markets beyond Europe?

Andy: We provide our white label platform services to a range of clients in markets across the globe, including powering Africa’s largest jackpot through Afromillionslotto. While our robust, secure and scalable lottery infrastructure is more than capable of meeting the requirements of any global market, we do have a defined emerging market focus as part of our overall growth strategy. Lottery systems in such markets have tended to be built on outdated legacy technology, lacking in the flexibility required to meet the demands of the modern player. The ease and speed with which we are able to deploy our solutions empowers our partners to deliver true speed to market, while also providing them with the freedom they require to focus on their brand and market positioning.

At Twelve40, we offer a wide range of lottery solutions capable of satisfying a range of varied market demands. We offer both primary lottery services whereby we provide the RNG and related game systems, as well as secondary lottery services utilising another lottery’s numbers, such as the German national lottery. Our lottery messenger can provide tickets from global lotteries, allowing us to service the requirements of operators in markets all over the world, complemented by our thriving range of instant win games.

Twelve40 offers white label online lottery platforms, slot games and lotto solutions. How do you see blockchain technology and artificial intelligence changing the way online lottery being operated?

Andy: There is no doubting the influence that the current pace of change is having on all technological industries, and iGaming is certainly no different. AI can elevate a traditional gaming platform in a variety of ways, and innovative providers are already taking advantage. By way of example, smartly-deployed AI solutions assist in getting to know your customer-base, allowing for predictive analytics, leading to better corporate decision making and more efficient use of targeted marketing.

Furthermore, at Twelve40 we have moved quickly in recognising the potential of blockchain to shake-up the iGaming space, and we supply the all-new platform and certified back-end technology for the Wild Crypto gaming platform, launching in February 2018 following a successful token sale. The platform has been built from the ground up in order to best deliver an engaging crypto gaming experience, and as such is designed for 18 decimal places where traditional platforms only support two.

We place a great deal of emphasis on remaining ahead of the curve, and will continue to do so as we move forward to realise our strategic growth ambitions.

It has been reported that Twelve40 is going to introduce an instant win game with the Football World Cup theme. Have you launched it? What are your other immediate launch plans?

Andy: We have indeed. We recently launched Lucky Shootout, an instant win game released with the World Cup in mind and an innovative feature set that we are confident will see it lay claim to enduring popularity long after the tournament draws to a close. Taking the form of a penalty shootout, Lucky Shootout gives players the opportunity to select their favourite teams and challenge a goalkeeper in the ultimate test of nerves. We put a lot of work into making sure players could engage with the experience through the emoting of the goalkeeper, a colourful character with both the agility to pull off a great save and the attitude to let the player know they were fortunate to score.

The game is scalable and customisable to the requirements of individual operators and jurisdictions, and its innovative feature set will see its popularity continue to endure.

We already offer a diverse range of expertly-constructed instant win games such as Pumpkin Master and Money Tree, and have also recently added Pirates Gone Wild, a swashbuckling adventure that sees players match a variety of nautical symbols to uncover buried treasure.

Source: Latest News on European Gaming Media Network

Latest News

GGPoker Launches WSOP Express: Your Fast Track To Poker’s Biggest Live Events!

GGPoker, the World’s Biggest Poker Room, today announced the launch of WSOP Express, a revolutionary new series of online qualifier tournaments designed to give every player the chance to win their way into the most prestigious live poker events on the planet.

WSOP Express utilizes a simple ‘steps’ format, allowing players to embark on their journey to glory from tiny buy-ins:

- Step 1: All-In or Fold 4-max Sit & Go – $0.50 or Step 1 ticket buy-in – Step 2 ticket prize

- Step 2: Spin & Gold 6-max Sit & Go – $2 or Step 2 ticket buy-in – Step 2-4 ticket or WSOP Pass prize

- Step 3: Turbo Tournament – $10 or Step 3 ticket buy-in – Step 4 ticket prize

- Step 4: Regular Tournament – $150 or Step 4 ticket buy-in – Ring Pass or Bracelet Pass prize

Players can start at Step 1 or buy directly into any step, making the path to live tournament poker accessible to all.

GGPoker will also host special step tournaments, which participants can play to win the bigger WSOP Express passes:

- Bracelet Step: Regular Tournament – $1,000 buy-in or ticket – Bracelet Pass prize

- Super Step: Regular Tournament – $2,500 buy-in or ticket – Super Pass prize

Free WSOP Express tickets can be claimed through various exciting promotions, including cash game challenges and more.

The available WSOP Express passes are:

- $5,000 Ring Pass: Your ticket to WSOP Super Circuit Live Events, this pass includes event buy-in plus expenses

- $10,000 Bracelet Pass: Grants entry to $10,000 WSOP bracelet events, such as next year’s iconic WSOP 2026 $10K Main Event in Las Vegas

- $30,000 Super Pass: The ultimate package for the WSOP Paradise Super Main Event, including your $26K entry, discounted accommodation at the exclusive Atlantis Paradise Island resort, and more

A key focus of WSOP Express is to open the doors to the newly announced WSOP Paradise 2025 Super Main Event. Taking place this December at Atlantis Paradise Island in the Bahamas, this monumental tournament boasts a record-breaking $60,000,000 prize guarantee, making it the largest live poker guarantee in history, shattering last year’s impressive $50,000,000 Super Main Event guarantee.

Sarne Lightman, Managing Director of GGPoker, shared his excitement: “This is a game-changer for the GGPoker community, literally. Imagine starting with a tiny buy-in and winning your way into the biggest live poker events on the planet, including the record-breaking $60,000,000 guaranteed WSOP Paradise Super Main Event in the Bahamas! WSOP Express is designed to turn dreams into reality, making the pinnacle of poker truly accessible for everyone – play WSOP Express and take the fast track to the WSOP!”

The WSOP Express journey is straightforward: complete steps, earn your pass, and enter the WSOP experience. This streamlined process ensures that players can easily track their progress towards their desired live event.

Visit GGPoker today to start your WSOP Express journey and take aim at poker’s biggest prizes: ggpoker.com/tournaments/wsop-express/

The post GGPoker Launches WSOP Express: Your Fast Track To Poker’s Biggest Live Events! appeared first on European Gaming Industry News.

Latest News

Week 29/2025 slot games releases

Here are this weeks latest slots releases compiled by European Gaming

Spinomenal has rolled out the latest addition to its iconic Demi Gods Series: Demi Gods VI Hold & Hit. In this new release, players are transported to a mystical realm surrounded by ominous mountains and swirling mists. The adventure unfolds within a 5×3 reel frame, where electric anticipation crackles around each spin. Atlas, Selene, Helios, and Hera are once again the main protagonists on a mission through ancient Greece in the hunt for glory.

Million Games is thrilled to announce the launch of Fortune Fairies, an enchanting new video slot that takes players into a mystical forest filled with magic, rewards, and a jackpot. This 5×3, high volatility slot invites players into a world, where ethereal fairies, shimmering orbs, and hidden treasures await. Designed for players who love immersive storytelling and rewarding gameplay, Fortune Fairies features two captivating bonus rounds.

GAMOMAT, one of the leading independent German software developers for slot games, has released Roman Legion Flaming Link, the latest addition to join the line-up of its hugely successful Flaming Link series. This imperious 5×3 slot marches players straight to the heart of the Roman Empire, where legionnaires must vie for victory.

PG Soft has unveiled its fantasy-fueled video slot, Dragon’s Treasure Quest. The game is presented within a 5-reel, 3-row frame and features expanding reels and multipliers. Players must track down hidden treasures while navigating through legendary lore to find Wilds and Scatters, represented by a dragon eye and treasure chest respectively.

BC.GAME is adding a dark twist to its slot lineup with the launch of Symbiote, a high-volatility crypto slot developed by Croco Gaming. Inspire by the cult comic Venom, the game invites players into a battle for control — where fusing with an alien parasite brings incredible power, but always at a cost. Symbiote draws heavy visual influence from comic book aesthetics, particularly from the Venom universe.

Get ready to don your sombrero and put your piñata smashing arm to the test in Piñateros – the brand-new Premium release from popular software provider, Swintt, where collecting six or more flaming chilis can unlock fiery rewards or one of four red-hot local jackpots. Boasting a colourful collection of symbols that serves up sugar, spice and all things nice, this exciting 5×3 reel, 50-payline slot includes fresh fruits, thirst-quenching beverages and Mexican musical instruments among its unique icons, with expanding wilds helping to create further wins.

Saddle up, slot fans! TaDa Gaming’s latest release, Bounty Frenzy, is here to ignite the reels with wild west energy, gold-studded features and nonstop action. Packed with cascading wins, dynamic multipliers and transforming Gold Frame Wilds, this medium-volatility slot delivers thrilling gameplay with a 5000x max win potential.

The chaos-loving Joker returns in Cashin’ Joker, a vibrant 3-reel slot from Play’n GO that doesn’t play by the rules. As numbers tumble onto the reels and transform into powerful multipliers, players are thrust into a fast-paced experience full of surprises and dramatic shifts in momentum. Every time the Joker symbol appears, the game shifts into another gear.

Red Rake Gaming has released Super 60 Stars, the latest addition to its acclaimed Super series, now available to all partner operators. This new release retains the fast-paced gameplay and wide variety of features that have made the series one of the most popular in the iGaming industry, while also introducing an exclusive new addition that adds even more excitement to the game. The new feature in Super 60 Stars is the “Super 60 Stars” symbol, which can appear anywhere on the reels and trigger the brand-new “Super 60 Gold X” minigame.

The post Week 29/2025 slot games releases appeared first on European Gaming Industry News.

Latest News

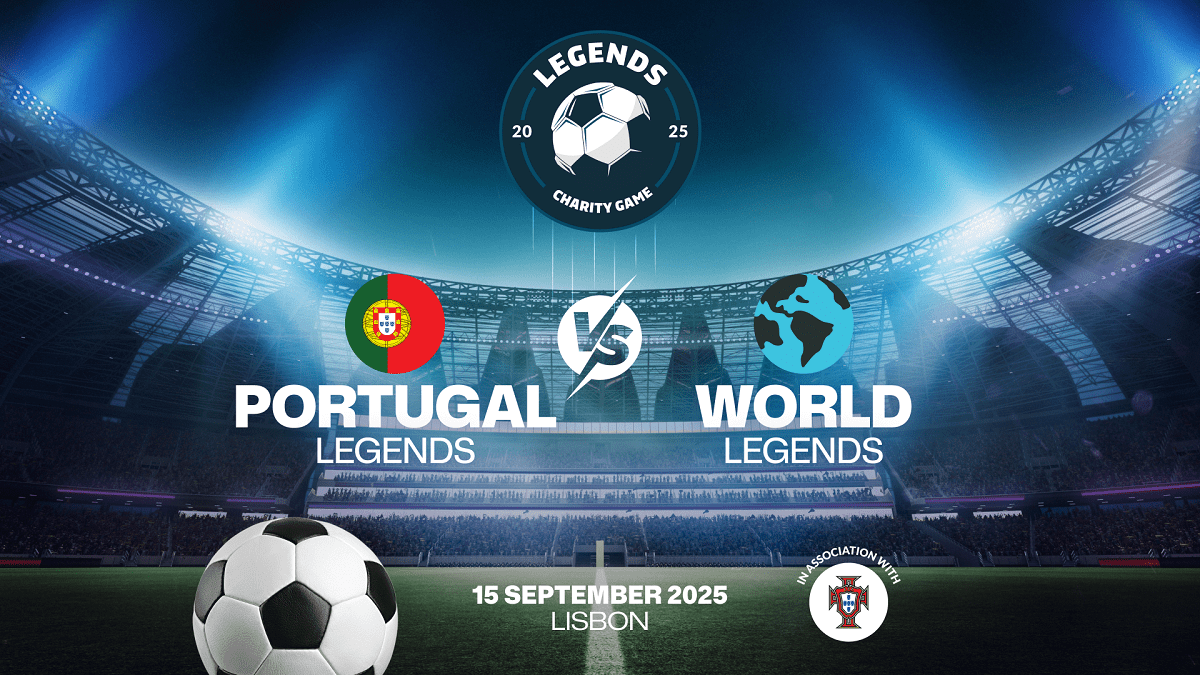

Legends Charity Game in Lisbon to raise millions for charity

International stars of the football world are coming together in Lisbon this September for the Legends Charity Game in order to raise funds for communities suffering from the effects of war and local tensions around the world.

Timed to coincide with the SBC Summit in Lisbon, the Legends Charity Game on Monday 15 September is a highly anticipated match between Portugal Legends vs. World Legends, featuring some of the biggest names in the history of football. The Legends will compete in front of 60,000 Fans, and in front of millions of people that will watch the game online / on TV.

With strong support from the Portuguese Football Federation (FPF), the match will see Portuguese legends playing against footballing royalty from the Rest of the World in an event that aims to raise over €1,000,000 for selected charities in the support of communities and families experiencing extreme hardship.

Luis Figo, who won trophies across Europe as well as the Ballon d’Or in 2000, will be captaining the Portugal Legends side. He comments: “It’s always a pleasure to come back to my country and play football, especially when wearing the national team colours! Hope to see a full stadium in my hometown Lisbon for this amazing Legends Charity Game and raise funds for important charity causes.”

Joining Figo from the triumphant Euro 2016 winning squad are Ricardo Quaresma, Eliseu and Ricardo Carvalho. Champions League winners Fábio Coentrão, Maniche, Hugo Almeida, Vitor Baia, José Bosingwa and Deco will also play on the night as well as other famous Portuguese legends include Beto, Jorge Andrade, Dani, Tiago Mendes, Hélder Postiga, Nuno Gomes and Simão. They will be managed by another Champions League winner – Costinha.

They will be facing stiff competition from the World Legends squad that includes legends such as: Peter Schmeichel (Denmark), Cafu (Brazil), Javier Zanetti (Argentina), Diego Lugano (Uruguay), Leonardo Bonucci (Italy), Gaizka Mendieta (Spain), Youri Djorkaeff (France), Christian Karambeu (France), Marek Hamsik (Slovakia), Giorgos Karagounis (Greece), Krassimir Balakov (Bulgaria), Gheorghe Hagi (Romania), Edwin van der Sar (Netherlands) Henrik Larsson (Sweden), Shota Arveladze (Georgia), Javier Saviola (Argentina), and Ronaldinho (Brazil).

The match will be played in front of 60,000 fans at either Estádio da Luz (Benfica Stadium) or José Alvalade Stadium (Sporting Lisbon Stadium), which will be part of a big and exciting reveal in August when the Champions League schedule is released.

The Legends Charity Game aims to raise over €1,000,000 for a number of good causes based both abroad and in Portugal as the Football Family aims to give back to the families of the world. Funds will be raised for both international and national charities who help families and communities in need.

One of the international organisations that The Legends Charity Game will be raising funds for is the Ukrainian Red Cross Society (URCS). Every day, the Ukrainian Red Cross teams provide evacuation support, psychosocial and first aid, provide essential humanitarian relief, support temporary shelters, help with housing restoration, and spread awareness about unexploded ordnance risks. Ukrainian Red Cross volunteers and staff work in all regions of the country to support those who need it most.

Maksym Dotsenko, Director General of the Ukrainian Red Cross, comments: “The war in Ukraine continues, and unfortunately, millions of people still need support every day. We have no right to stop. Initiatives like the Legends Charity Game are not just about the funds raised. They are about compassion, and the understanding that the world stands by us. They are about solidarity that transforms into real help for those going through the toughest times. We are grateful to everyone who takes part.”

The Lisbon-based Cáritas Portuguesa, which offers critical support to marginalised communities fighting issues such as poverty and inadequate emergency relief, is also a charitable partner for the Legends Charity Game.

SBC Founder & CEO Rasmus Sojmark explains: “We are taking our charitable endeavours up a notch this year with the spectacular football match in order to raise a lot of money for some very worthy causes. By tying the match in with the SBC Summit in Lisbon the same week, we have found a way for the communities around football and business to help other communities that are facing unimaginable hardships.”

Tickets are available to purchase via the official website www.legendscharitygame.com. See Tickets will handle ticket management of the event.

Sponsorships and Hospitality are still available in support of the event and the charities. Some of the sponsors already confirmed include iGP, Soft2Bet, Sportingtech, Vegas Legends, Spribe, SmartSoft and Alea.

Sport Global Charitable Foundation is a restricted fund under the auspices of Prism the Gift Fund (UK registered charity with charity number 1099682). All of the profits from the Legends Charity Game will support the Sport Global Charitable Foundation’s beneficiary charities across a range of causes including the Ukrainian Red Cross Society and Caritas Portugal.

The post Legends Charity Game in Lisbon to raise millions for charity appeared first on European Gaming Industry News.

-

Latest News3 months ago

Latest News3 months agoWeek 17/2025 slot games releases

-

Latest News3 months ago

Latest News3 months agoFortuna Partners with 2025 UEFA Under-21 EURO

-

Latest News2 months ago

Latest News2 months agoELA Games Receives Key Nomination at EGR Marketing & Innovation Awards

-

Latest News3 months ago

Latest News3 months agoBojoko.com Surpasses €100 Million in All-Time Deposits Milestone

-

Latest News3 months ago

Latest News3 months agoLeoVegas Group to Open a New Office in Leeds

-

Latest News2 months ago

LEGENDS by Fire & Ice: July 1st at The BOX Soho

-

Latest News1 month ago

New Resort & Casino Selects IvedaAI for Intelligent Video Surveillance Ahead of Grand Opening

-

Latest News1 month ago

HIPTHER Movement Launched: Fitness Community & Summer Run-Off Challenge Powered by GameOn

You must be logged in to post a comment Login