Latest News

Notice of Kambi Group Plc Extraordinary General Meeting 2023

In terms of Articles 41 and 42 of the Articles of Association of the Company

NOTICE IS HEREBY GIVEN that that AN EXTRAORDINARY GENERAL MEETING (the “Meeting”) of Kambi Group plc, company number C 49768 (the “Company”) will be held on Monday 19 June 2023 at 11.00 CEST at Kambi, Hälsingegatan 38, 113 43 Stockholm, Sweden, to consider the following Agenda. The registration of shareholders starts at 10.30 CEST.

Right to attendance and voting

• To be entitled to attend and vote at the Meeting (and for the purpose of the determination by the Company of the number of votes they may cast), shareholders must be entered on the Company’s register of members maintained by Euroclear Sweden AB by Monday 29 May 2023

• Shareholders whose shares are registered in the name of a nominee should note that they may be required by their respective nominee/s to temporarily re-register their shares in their own name in the register of members maintained by Euroclear Sweden AB in order to be entitled to attend and vote (in person or by proxy) at the Meeting. Any such re-registration would need to be effected by Monday 29 May 2023. Shareholders should therefore liaise with and instruct their nominees well in advance thereof.

• To be entitled to attend and vote in person at the Meeting, shareholders must notify Euroclear Sweden AB of their intention to attend the Meeting by Monday 29 May 2023 and can do so by (i) e-mail to [email protected] or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE-101 23 Stockholm, Sweden or (iii) by phone on +46 8 402 9092 during the office hours of Euroclear Sweden AB. Notification should include the shareholder’s name, address, email address, daytime telephone number, personal or corporate identification number, number of shares held in the Company, as well as details of any proxies (if applicable, in the case that the shareholder has appointed a third party representative to attend the Meeting in their stead). Information submitted in connection with the notification will be computerised and used exclusively for the Meeting. See below for additional information on the processing of personal data.

Shareholders’ right to appoint a proxy

• A shareholder who is entitled to attend and vote at the Meeting, is entitled to appoint one or more proxies to attend and vote on his or her behalf. A proxy need not also be a shareholder. If the shareholder is an individual, the proxy form must be signed by the appointer (or his authorised attorney) or comply with Article 126 of the Articles. If the shareholder is a corporation, the proxy form must be signed on its behalf by an authorised attorney or a duly authorised officer of the corporation or comply with Article 126 of the Articles.

• Proxy forms must clearly indicate whether the proxy is to vote in their discretion or in accordance with the voting instructions sheet attached to the proxy form. Your proxy shall vote as you have directed in respect of the resolutions set out in this notice or on any other resolution that is properly put to the meeting. If the proxy form is returned to the Company without any indication as to how the proxy shall vote, generally or in respect of a particular resolution, the proxy shall exercise their discretion as to how to vote or whether to abstain from voting, generally or in respect of that particular resolution (as applicable).

• Where the shareholder is a corporation, a document evidencing the signatory right of the officer signing the proxy form, must be submitted with the proxy form. Where the proxy form is signed on behalf of the shareholder by an attorney (rather than by an authorised representative, in the case of a corporation), the original power of attorney or a copy thereof certified or notarised in a manner acceptable to the Board of Directors must be submitted to the Company, failing which the appointment of the proxy may be treated as invalid.

• The original signed proxy form and, if applicable, other supporting documents (required pursuant to the above instructions), must be received by Euroclear Sweden AB no later than Monday 29 May 2023 by (i) e-mail to [email protected] or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE-101 23 Stockholm, Sweden. Shareholders are therefore encouraged to submit their proxy forms (and other supporting documents, if any) as soon as possible.

• Proxy forms are available on the Company website www.kambi.com under the General Meetings section

• Aggregated attendance notifications and proxy data processed by Euroclear Sweden AB must be transmitted to and received by the Company by email at [email protected] not less than 48 hours before the time appointed for the Meeting and in default shall not be treated as valid

Agenda

1. Opening of the Meeting

2. Election of Chairman of the Meeting

3. Drawing up and approval of the voting list

4. Approval of the Agenda

5. Determination that the Meeting has been duly convened

6. Election of two persons to approve the minutes

Special Business (Extraordinary Resolutions)

7. THAT the Directors be and are hereby duly authorised and empowered in accordance with Articles 85(1) and 88(7) of the Companies Act and Article 3 of the Articles, on one or several occasions prior to the date of the next Annual General Meeting of the Company, to issue and allot up to a maximum of 3,127,830 Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each (corresponding to a dilution of 10% of total shares as at the date of the notice to the 2023 Annual General Meeting) for payment in kind or through a direct set-off in connection with an acquisition, and to authorise and empower the Directors to restrict or withdraw the right of pre-emption associated to the issue of the said shares. This resolution is being taken in terms and for the purposes of the approvals necessary in terms of the Companies Act and the Articles of Association of the Company. (Resolution a)

8. WHEREAS (i) at a meeting of the Board of Directors of the Company held on 3 April 2023, the Directors resolved to obtain authority to buy back Ordinary ‘B’ shares in the Company having a nominal value of €0.003 each; and

(ii) pursuant to Article 5 of the Articles and Article 106(1) (b) of the Companies Act a company may acquire any of its own shares otherwise than by subscription, provided inter alia authorisation is given by an extraordinary resolution, which resolution will need to determine the terms and conditions of such acquisitions and in particular the maximum number of shares to be acquired, the duration of the period for which the authorisation is given and the maximum and minimum consideration.

NOW THEREFORE the members of the Company resolve that the Company be generally authorised to make purchases of Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each in its capital, subject to the following:

(a) the maximum number of shares that may be so acquired is 3,127,830 which is equivalent to 10% of total shares as at the date of the notice to the 2023 Annual General Meeting;

(b) the minimum price that may be paid for the shares is SEK1 per share;

(c) the maximum price that may be paid for the shares is SEK1,000 per share;

(d) the maximum aggregate number of shares that can either be i) issued and allotted under Resolution a and, ii) bought back under this Resolution b, shall not exceed 3,127,830; and

(e) the authority conferred by this resolution shall expire on the date of the 2024 Annual General Meeting, but in any case shall not exceed the period of 18 months, but not so as to prejudice the completion of a purchase contracted before that date. (Resolution b)

9. Closing of the Extraordinary General Meeting

Information about proposals related to Agenda items

Both extraordinary Resolutions, Resolutions a and b, were presented in their entirety to the Annual General Meeting held on 11 May 2023 (which resolutions were referred to therein as resolutions m and n respectively), and obtained one majority of two required in terms of article 135 of the Companies Act (Cap 386), and in terms of Articles 48B.2(b) of the Articles of Association of the Company. To this end, this Extraordinary General Meeting is being convened within 30 days of the Annual General Meeting, in accordance with the aforementioned provisions of the Companies Act and the Articles, in order to take a fresh vote on the proposed extraordinary resolutions.

Agenda item 7 (Resolution a)

The objectives of the authorisation are to increase the financial flexibility of the Company and to enable the Company to use its own financial instruments for payment in kind or through a directed set-off to a selling partner in connection with any business acquisitions the Company may undertake or to settle any deferred payments in connection with business acquisitions. The market value of the shares on each issue date will be used in determining the price at which shares will be issued. For the purposes of Article 88(7) of the Companies Act, through this resolution the members of the Company are also authorising the Board of Directors to restrict or withdraw the members’ right of pre-emption that would normally entitle members to be offered the newly issued shares in the Company in proportion to their shareholding before such new shares are offered to third parties.

Agenda item 8 (Resolution b)

The Board of Directors proposes that the acquisition by the Company of its own shares shall take place on First North Growth Market at Nasdaq Stockholm or via an offer to acquire the shares to all members of the Company. Such acquisitions of own shares may take place on multiple occasions and will be based on market terms, prevailing regulations and the capital situation at any given time. Notification of any purchase will be made to First North Growth Market at Nasdaq Stockholm and details will appear in the Company’s annual report and accounts. Any resolution to repurchase own shares will be publicly disclosed. The objective of the buyback and transfer right is to ensure added value for the Company’s shareholders and to give the Board increased flexibility with the Company’s capital structure.

Following such buybacks, the intention of the Board would be to either cancel, use as consideration for an acquisition or transfer to employees under a company share incentive plan. Once repurchased, further shareholder and Bondholder approval would be required before those shares could be cancelled.

If used as consideration for an acquisition the intention would be that they would be issued as shares and not sold first.

Latest News

EGT to make a memorable show at Belgrade Future Gaming 2024

Only a few days remain until Belgrade Future Gaming 2024, where EGT will demonstrate its vision for the future of the gaming industry. The latest innovations alongside the company’s well-established products will be available to guests at stand E1.

The Phoenix slot cabinet will stand out among the top offers for the Serbian gaming audience. Powered by the latest Exciter IV platform and including 27-inch monitors, keyboard with dynamic touch display and electromechanical buttons and numerous ergonomic features, this model has already gained popularity in a number of markets around the world and is expected to reap success in Serbia as well. It will be equipped with the bestseller Bell Link, which will introduce its new multigame Bell Link 2. The mix contains 10 exciting games and provides players with even more opportunities to win and have fun.

Supreme Green Selection, the first multigame of the latest Supreme Selection Series of EGT, will also make its local debut. Including a fascinating set of 50 titles on different themes, it will certainly not go unnoticed by visitors to the stand.

Guests will also have the opportunity to enjoy the variety of slots of the well-known General and Power Series multigames, as well as test their luck with the Gods & Kings Link jackpot. The slot selection will be complemented by cabinets from the General Series.

EGT’s multiplayer portfolio will be also on display. The roulettes G R6 C and the terminals G 32 T will showcase their eye-catching design, multiple ergonomic features and great flexibility, allowing many possible configurations with other devices.

The company’s casino management system Spider will also demonstrate its latest modules, which make the management of the daily activities in gaming establishments easy and effective.

EGT Digital will present its iGaming solutions as well. The provider will show its wide diversity of instant and casino games, jackpot solutions, as well as the in-house developed all-in-one betting platform X-Nave with its four main modules, which provides operators with everything needed to build and maintain a successful online business.

“Belgrade Future Gaming is an exhibition of great significance for Serbia and the region, and I am happy that we will take part in this year’s edition as well,” said Aleksandar Kliska, General Director of EGT Group d.o.o. Serbia. “It will give us the opportunity to reveal the huge potential of our products and solidify our leadership positions in the local market.”

The post EGT to make a memorable show at Belgrade Future Gaming 2024 appeared first on European Gaming Industry News.

Latest News

Gaming Innovation Group – Mandatory notification of trade

Mikael Riese Harstad, Chairman of the Board and primary insider of Gaming Innovation Group Inc.

(GiG), has today transferred 864,403 shares in GiG to a life insurance policy with SEB Life International Assurance Company DAC with himself as the sole policy holder.

In addition, Helena Riese Harstad, a close associate of Mikael Riese Harstad, has today transferred 477,733 shares in GiG to a life insurance policy with SEB Life International Assurance Company DAC with herself as the sole policy holder.

After these transactions, Harstad and close associates owns no shares directly, but hold 1,342,136 shares through life insurance policies with SEB Life International Assurance Company DAC.

For further information, contact:

Tore Formo, Group CFO, [email protected] +47 916 68 678

This information is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act.

The post Gaming Innovation Group – Mandatory notification of trade appeared first on European Gaming Industry News.

Latest News

Clarion Gaming and ExCeL London plan for the migration of iGB L!VE 2025 to the heart of igaming

Clarion Gaming is advancing preparations for the migration of iGB L!VE to London in July 2025 establishing a roadmap of activities in partnership with the senior team at ExCeL London which will host the leading global event.

The latest meeting between the two organisations featured:

- iGB L!VE Portfolio Director Naomi Barton,

- Clarion Gaming Managing Director Stuart Hunter,

- Head of Operations Richard Logan and

- Head of Marketing Jody Frost with the senior team from ExCeL led by the venue’s

- Chief Commercial Officer Simon Mills.

Expanding on the meeting Naomi Barton said: “This was the second senior level planning meeting that we have held with our colleagues at ExCeL London in order to move the home of the igaming community to a city which is the heart of the igaming industry in a country which is igaming’s largest market.

“The roadmap is being created in order to anticipate industry needs, address pain points and to exceed the expectations of customers. The migration of what is already a top performing Tier One igaming event is set against the backdrop of iGB L!VE’s 5-year growth plan which is focused on delivering 35,000 visitors and over 550 exhibitors and sponsors by 2029.

“Our vision is to harness the tremendous momentum created by the iGB L!VE brand and to take the event to a whole new level in a new venue, and a new exceptionally well-connected global home in the city of London.

“ExCeL London has a fantastic track record of helping events to fulfil their potential, and all of the building blocks are in place for iGB L!VE and its customers to accelerate their businesses to new heights in London.

She added: “Placing our customers at the heart of everything that we do is central plank to the iGB L!VE growth strategy, and the roadmap for 2025 is underpinned by a clear customer-focused programme that will ensure maximum cost-effectiveness as well as global growth for all of our stakeholders.

“We will be using July’s edition of iGB L!VE not only to reflect and celebrate our time in Amsterdam and say thank you to our fantastic partners for many years RAI Amsterdam, but also enable our vendors and customers to secure their presence at ExCeL London in 2025.”

The post Clarion Gaming and ExCeL London plan for the migration of iGB L!VE 2025 to the heart of igaming appeared first on European Gaming Industry News.

-

Latest News3 months ago

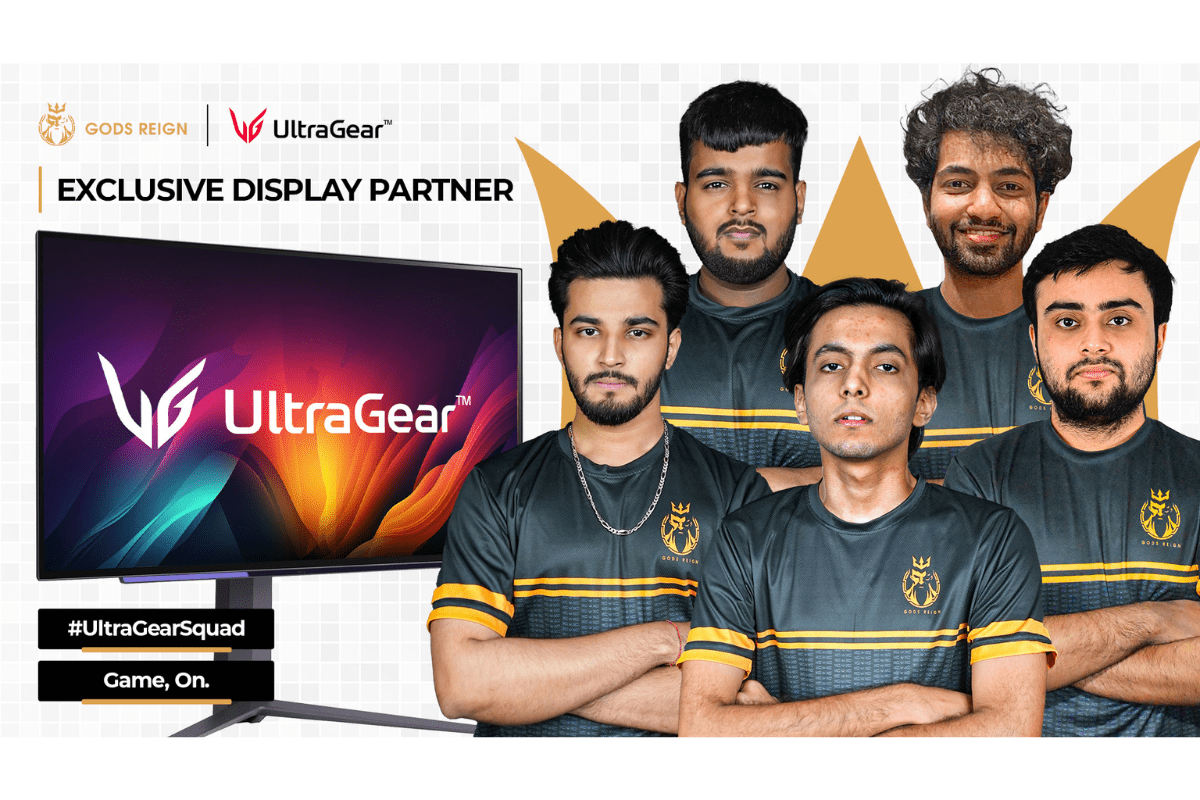

Latest News3 months agoGods Reign Announces Groundbreaking Partnership with LG Electronics

-

Latest News3 months ago

Latest News3 months agoEuropean Gaming Q1 2024 Meetup: Exploring Innovation, Marketing, and the iGaming Industry Hubs

-

Latest News3 months ago

Latest News3 months agoFrench Publisher TapNation tops Financial Times FT1000 list of Europe’s Leaders in Tech Media

-

Latest News3 months ago

Latest News3 months agoHölle Games Go Live on Bet-at-home.de

-

Latest News3 months ago

Latest News3 months agoFast Track’s Simon Lidzén Wins Best CEO 2024 Award at Sigma Eurasia

-

Latest News1 month ago

Latest News1 month agoCopenhagen Major 2024 – Betting Overview

-

Latest News2 months ago

Latest News2 months agoStakelogic’s Slot and Live Casino Content is now live with L&L Europe

-

Latest News3 months ago

Latest News3 months agoTHE BATTLE OF POLYTOPIA ARRIVES ON APPLE ARCADE

You must be logged in to post a comment Login