Latest News

Global $192 Billion Online Gambling Markets, Opportunities and Strategies, 2015-2020, 2025F, 2030F

The “Online Gambling Global Market Opportunities And Strategies To 2030, By Game Type, Device” report has been added to ResearchAndMarkets’ offering.

The online gambling market reached a value of nearly $76,792.7 million in 2020, having increased at a compound annual growth rate (CAGR) of 13.7% since 2015. The market is expected to grow from $76,792.7 million in 2020 to $127,451.4 million in 2025 at a rate of 10.7%. The market is then expected to grow at a CAGR of 8.6% from 2025 and reach $192,264.4 million in 2030.

Growth in the historic period resulted from strong economic growth in emerging markets, growing adoption of smartphones with improved internet accessibility, increasing popularity of digital payments and rise in disposable income.

Going forward, increasing gamer involvement during the covid-19 pandemic, increasing consumer acceptance for fintech, technically advanced platforms, legalization of gambling and changing consumer gambling habits will drive the growth. Factors that could hinder the growth of the online gambling market in the future include global recession, regulatory restrictions to curb gambling addiction, demographic changes and security challenges

The online gambling market is segmented by game type into betting, casino, lottery, poker, online bingo, and others. The betting market was the largest segment of the online gambling market segmented by game type, accounting for 46.7% of the total in 2020. Going forward, the lottery segment is expected to be the fastest growing segment in the online gambling market segmented by game type, at a CAGR of 16.8% during 2020-2025.

The online gambling market is also segmented by device into desktop, mobile and other devices. The desktop market was the largest segment of the online gambling market segmented by device, accounting for 57.9% of the total in 2020. Going forward, the mobile segment is expected to be the fastest growing segment in the online gambling market segmented by device, at a CAGR of 17.4% during 2020-2025.

Asia Pacific was the largest region in the online gambling market, accounting for 31.9% of the total in 2020. It was followed by Western Europe, and then the other regions. Going forward, the fastest-growing regions in the online gambling market will be Western Europe, and, Asia Pacific where growth will be at CAGRs of 10.83% and 10.81% respectively. These will be followed by South America, and Middle East, where the markets are expected to grow at CAGRs of 10.7% and 10.5% respectively.

The online gambling market is fairly fragmented, with a large number of players. The top ten competitors in the market made up to 23.15% of the total market in 2020. The key players in the market are focusing on continuous product innovations, mergers & acquisition to expand its market presence and to gain competitive edge in the market.

Flutter Entertainment plc was the largest competitor with 6.06% of the market, followed by bet365 Group Ltd. with 4.80%, Entain plc with 4.66%, Kindred Group plc with 1.96%, William Hill PLC with 1.55%, 888 Holdings PLC with 1.06%, International Game Technology PLC with 1.03%, Betsson Ab with 0.96%, DraftKings Inc. with 0.61% and Betfred with 0.46%.

The top opportunities in the online gambling market segmented by game type will arise in the betting segment, which will gain $21,415.9 million of global annual sales by 2025. The top opportunities in segment by device will arise in the mobile segment, which will gain $35,462.1 million of global annual sales by 2025. The online gambling market size will gain the most in the USA at $8,453.8 million.

Market-trend-based strategies for the online gambling market include investing in AI technology to enhance user experience, integrating cryptocurrency as a payment mode, building mobile apps, investing in AR and VR technology, sponsoring sports events with large viewership, tie-up with celebrities and influencers, offer free access to games with certain main features and offer cross platform support for games.

Key Topics Covered:

1. Online Gambling Market Executive Summary

2. Table of Contents

3. List of Figures

4. List of Tables

5. Report Structure

6. Introduction

6.1. Segmentation By Geography

6.2. Segmentation By Game Type

6.3. Segmentation By Device

7. Online Gambling Market Characteristics

7.1. Market Definition

7.2. Segmentation By Game Type

7.2.1. Betting

7.2.2. Casino

7.2.3. Lottery

7.2.4. Poker

7.2.5. Online Bingo

7.2.6. Others

7.3. Segmentation By Device

7.3.1. Desktop

7.3.2. Mobile

7.3.3. Other Devices

8. Online Gambling Market Trends And Strategies

8.1. Use Of Artificial Intelligence In Online Gambling

8.2. Blockchain In Online Gambling

8.3. Mobile Gambling

8.4. Virtual Reality/Augmented Reality To Enhance User Experience

8.5. Online Gambling Companies Sponsoring Sports Teams

8.6. Celebrity Endorsements

8.7. Freemium Models In Online Gambling

8.8. Cross Platform Gambling Games

9. Impact Of COVID-19 On The Online Gambling Market

9.1. Introduction

9.2. Impact On Major Regions

9.2.1. North America

9.2.2. Asia-Pacific

9.2.3. Europe

9.3. Impact On Sports Betting

9.4. Conclusion

10. Global Online Gambling Market Size And Growth

10.1. Market Size

10.2. Historic Market Growth, 2015 – 2020, Value ($ Million)

10.2.1. Drivers Of The Market 2015 – 2020

10.2.2. Restraints On The Market 2015 – 2020

10.3. Forecast Market Growth, 2020 – 2025, 2030F Value ($ Million)

10.3.1. Drivers Of The Market 2020 – 2025

10.3.2. Restraints On The Market 2020 – 2025

11. Global Online Gambling Market Segmentation

11.1. Global Online Gambling Market, Segmentation By Game Type, Historic And Forecast, 2015 – 2020, 2025F, 2030F, Value ($ Million)

11.2. Global Online Gambling Market, Segmentation By Device, Historic And Forecast, 2015 – 2020, 2025F, 2030F, Value ($ Million)

12. Online Gambling Market, Regional And Country Analysis

12.1. Global Online Gambling Market, By Region, Historic and Forecast, 2015 – 2020, 2025F, 2030F, Value ($ Million)

12.2. Global Online Gambling Market, By Country, Historic and Forecast, 2015 – 2020, 2025F, 2030F, Value ($ Million)

Companies Mentioned

- Flutter Entertainment plc

- bet365 Group Ltd.

- Entain plc

- Kindred Group plc

- William Hill PLC

- 888 Holdings PLC

- International Game Technology PLC

- Betsson Ab

- DraftKings Inc.

- Betfred

Latest News

Gaming Innovation Group – Mandatory notification of trade

Mikael Riese Harstad, Chairman of the Board and primary insider of Gaming Innovation Group Inc.

(GiG), has today transferred 864,403 shares in GiG to a life insurance policy with SEB Life International Assurance Company DAC with himself as the sole policy holder.

In addition, Helena Riese Harstad, a close associate of Mikael Riese Harstad, has today transferred 477,733 shares in GiG to a life insurance policy with SEB Life International Assurance Company DAC with herself as the sole policy holder.

After these transactions, Harstad and close associates owns no shares directly, but hold 1,342,136 shares through life insurance policies with SEB Life International Assurance Company DAC.

For further information, contact:

Tore Formo, Group CFO, [email protected] +47 916 68 678

This information is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act.

The post Gaming Innovation Group – Mandatory notification of trade appeared first on European Gaming Industry News.

Latest News

Clarion Gaming and ExCeL London plan for the migration of iGB L!VE 2025 to the heart of igaming

Clarion Gaming is advancing preparations for the migration of iGB L!VE to London in July 2025 establishing a roadmap of activities in partnership with the senior team at ExCeL London which will host the leading global event.

The latest meeting between the two organisations featured:

- iGB L!VE Portfolio Director Naomi Barton,

- Clarion Gaming Managing Director Stuart Hunter,

- Head of Operations Richard Logan and

- Head of Marketing Jody Frost with the senior team from ExCeL led by the venue’s

- Chief Commercial Officer Simon Mills.

Expanding on the meeting Naomi Barton said: “This was the second senior level planning meeting that we have held with our colleagues at ExCeL London in order to move the home of the igaming community to a city which is the heart of the igaming industry in a country which is igaming’s largest market.

“The roadmap is being created in order to anticipate industry needs, address pain points and to exceed the expectations of customers. The migration of what is already a top performing Tier One igaming event is set against the backdrop of iGB L!VE’s 5-year growth plan which is focused on delivering 35,000 visitors and over 550 exhibitors and sponsors by 2029.

“Our vision is to harness the tremendous momentum created by the iGB L!VE brand and to take the event to a whole new level in a new venue, and a new exceptionally well-connected global home in the city of London.

“ExCeL London has a fantastic track record of helping events to fulfil their potential, and all of the building blocks are in place for iGB L!VE and its customers to accelerate their businesses to new heights in London.

She added: “Placing our customers at the heart of everything that we do is central plank to the iGB L!VE growth strategy, and the roadmap for 2025 is underpinned by a clear customer-focused programme that will ensure maximum cost-effectiveness as well as global growth for all of our stakeholders.

“We will be using July’s edition of iGB L!VE not only to reflect and celebrate our time in Amsterdam and say thank you to our fantastic partners for many years RAI Amsterdam, but also enable our vendors and customers to secure their presence at ExCeL London in 2025.”

The post Clarion Gaming and ExCeL London plan for the migration of iGB L!VE 2025 to the heart of igaming appeared first on European Gaming Industry News.

Latest News

Paf’s results for 2023

The Nordic gaming company Paf’s annual report for 2023 shows that it has been a good year which means a good sum of Paf funds for society. Paf’s published customer segments show more sustainable revenue in the past year. The Paf board gets a new member.

The Paf Group’s revenue for 2023 increased from €165.7 million to €177.1 million, an increase of 7%. The growth in revenue results in an increase in profit from €44.8 million to €55.1 million, which is a record for Paf.

“We can be happy and proud with the past year. We have gained a larger customer base and the number of active customers has increased by 27%, which explains some of it, but we are also well aware that the temporarily low gaming taxes in Finland have helped the result,” says Christer Fahlstedt, CEO.

Paf’s result is the best result in Paf’s 57-year history and an increase of 23% compared to the previous year. However, gaming taxes in a number of countries will be increased in 2024, which will create different conditions going forward. In Finland, the temporary reduction of the lottery tax has increased from 5% to 12%, in Sweden the gambling tax will increase from 18% to 22%, in Estonia from 5% to 6% and in Latvia from 10% to 12%.

“The trend of increasing gaming taxes will continue, and we expect to see more much-needed demands for increased responsible gaming measures. The changes will result in reduced profitability and many operators will find it more difficult. But Paf is well prepared for the times ahead,” says Christer Fahlstedt.

31.4 million euros in Paf funds

The annual distribution of Paf funds will be €31.4 million. Paf funds are used for the benefit of society, including a number of third sector organisations that work to promote society in social activities, culture, youth work, sports, environmental activities and more.

“It’s undeniably great that Paf is achieving a great result, allowing us to distribute a total of €31.4 million in the form of Paf funds. The employees have done a phenomenal job over the past year, and the Board would like to thank all Paf employees who have made this possible,” says Jan-Mikael von Schantz, Chairman of the Paf Board.

Sustainable entertainment

In 2023, Paf chose to invest heavily in responsible gaming, and the loss limit for all customers was lowered to EUR 17,500 per year. In addition, in spring 2023, Paf introduced a specific loss limit for young players aged 18–19, €1,800 per year. In spring 2024, Paf chose to lower the loss limit for young people aged 20–24. Young people of that age already had a lower loss limit at Paf but it was further reduced from €10,000 to €8,000 per year.

“This is an important continuation of the direction we are striving to take at Paf for our responsible gaming. Now young customers can only gamble with us for sums that are at more sustainable levels and within the framework of the customer segment we have defined ourselves as the green segment,” says Christer Fahlstedt.

Paf’s customer segments 2017–2023

The published table shows the development of gaming in different customer segments from 2017 until 2023. The red segment for customers who have lost more than €30,000 in one year is at zero in recent years, as Paf’s loss limits stop large losses. The white segment shows the number of players who ended the year in profit.

“It is encouraging to see that we have once again increased the green revenues with more sustainable revenues by a full 7.6%. It is possible to change an outdated business model in the industry and we will continue our strive to be a gaming company that provides sustainable entertainment in everyday life,” says Christer Fahlstedt.

The figures for Paf’s customer segments have been reviewed by auditors as part of the audit of the financial statements.

“Our published and open customer segments show what our investments in responsible gaming measures have achieved over the years. The publication gives credibility to our efforts at a level that no other gaming company has been able to show,” says Christer Fahlstedt.

Daniela Forsgård new on the board

Paf gets a new board member when Daniela Forsgård takes a seat on the board. At the same time, Birgitta Eriksson is stepping down after many years on Paf’s board.

“I really want to thank Birgitta for the solid contribution she has made to Paf’s Board over the years.”

“Daniela Forsgård’s merit-based knowledge of finance, combined with the international experience she possesses, will fit in well with the Board. In addition, Daniela has personal experience of Paf as she previously worked at Paf,” says Jan-Mikael von Schantz.

The Paf Board now consists of Chairman Jan-Mikael von Schantz, Board members Gunnar Westerlund, Denise Johansson, Roger Nordlund and Daniela Forsgård.

The post Paf’s results for 2023 appeared first on European Gaming Industry News.

-

Latest News3 months ago

Latest News3 months agoFairplay Exchange signs as new sponsor of Stephen Hendry’s Cue Tips

-

Latest News3 months ago

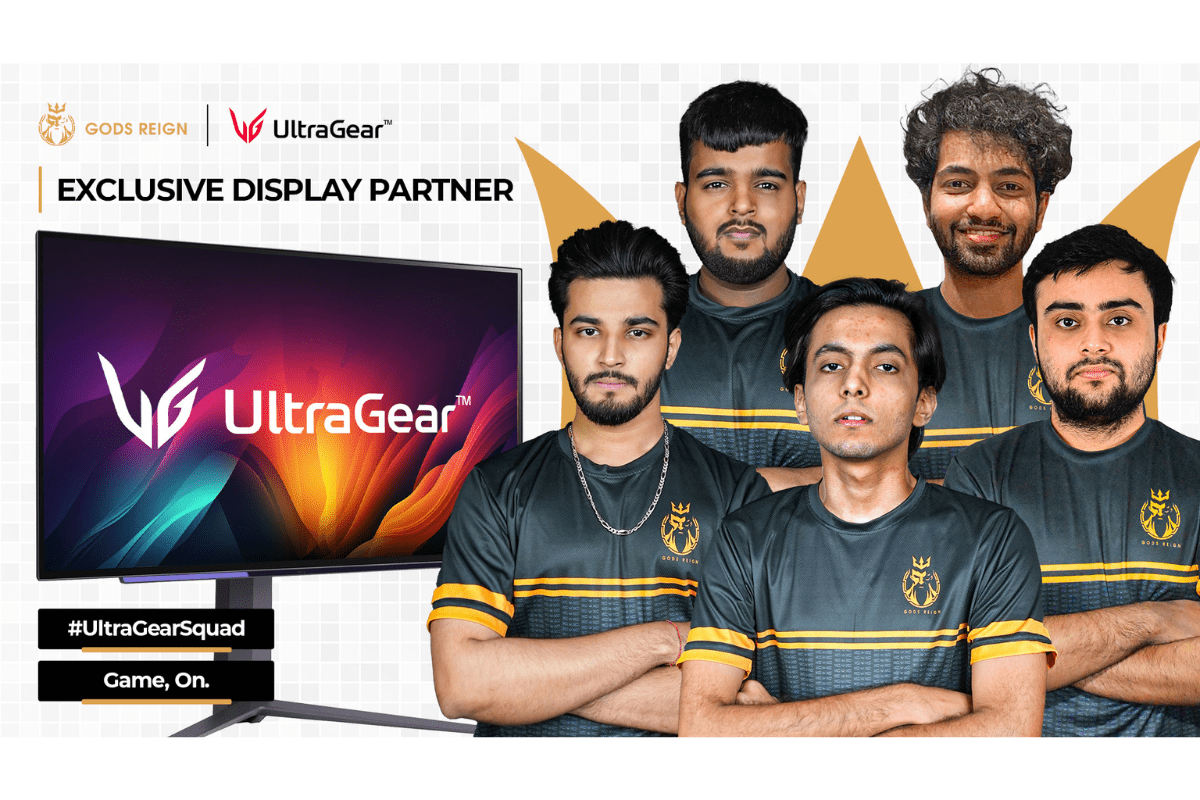

Latest News3 months agoGods Reign Announces Groundbreaking Partnership with LG Electronics

-

Latest News3 months ago

Latest News3 months agoEuropean Gaming Q1 2024 Meetup: Exploring Innovation, Marketing, and the iGaming Industry Hubs

-

Latest News3 months ago

Latest News3 months agoFrench Publisher TapNation tops Financial Times FT1000 list of Europe’s Leaders in Tech Media

-

Latest News3 months ago

Latest News3 months agoHölle Games Go Live on Bet-at-home.de

-

Latest News3 months ago

Latest News3 months agoFast Track’s Simon Lidzén Wins Best CEO 2024 Award at Sigma Eurasia

-

Latest News3 months ago

Latest News3 months agoGaming Americas Weekly Roundup – February 19-25

-

Latest News2 months ago

Latest News2 months agoStakelogic’s Slot and Live Casino Content is now live with L&L Europe

You must be logged in to post a comment Login