Latest News

Azerion successfully completes its business combination with EFIC1

Azerion Holding B.V., a high-growth, profitable, digital entertainment and media company, and European FinTech IPO Company 1 B.V. (“EFIC1”), a special purpose acquisition company (SPAC) listed on Euronext Amsterdam, have successfully completed their business combination on 1 February 2022.

As part of the completion of the business combination, the legal form of the combined company has been converted into a limited company (naamloze vennootschap) and it has been renamed Azerion Group N.V. (“Azerion Group”). The first day of trading on Euronext Amsterdam under the new name of Azerion Group’s shares and warrants will be on 2 February 2022 (today) under the new ticker symbols AZRN and AZRNW, respectively.

The business combination received the support of EFIC1’s shareholders, with more than 95% of the votes cast at EFIC1’s extraordinary general meeting held on 31 January 2022 (the “EGM”) approving the business combination.

The completion of the business combination supports Azerion Group in its ambitions to become a global digital entertainment and media powerhouse. The business combination furthermore provides for a strong complementary partnership accelerating future value creation for all stakeholders through continued investments in Azerion Group’s growth, both organically and through M&A. Azerion Group expects this listing to create a new long-term supportive shareholder base, permit Azerion Group to incentivise the existing and future management team and senior staff and continue to attract high calibre individuals.

The business combination resulted in approximately €93 million of gross total primary cash proceeds, including approximately €70 million of funds from the EFIC1 escrow account (net of negative interest and after effectuation of the share repurchase arrangement) complemented by a sponsor and co investor commitment of €23.15 million. With the completion of the business combination, Azerion Group received approximately €56 million of net primary cash proceeds (net of transaction costs and expenses), which will be used to continue to pursue value-accretive acquisitions (with Azerion having a strong acquisition track record and a broad pipeline of potential targets), and to further invest in organic growth initiatives (such as new games and features, platform investments, etc.) as well as general corporate purposes.

Immediately after completion of the business combination and the related restructuring steps (including the cancellation of 31,228,299 ordinary shares that were repurchased by EFIC1 from its shareholders), the issued share capital of Azerion Group is as follows:

1

Public

Type of security #¹

Ordinary Shares (excl. treasury) 111,483,296

Ordinary Shares in treasury² 70,078,452

Total Ordinary Shares 181,561,748

Capital Shares 22

Conditional Special Shares 1,152,886

Warrants³ 12,736,605

Please see section 6.4. “Description of Securities” in the EFIC1 Shareholders Circular dated 13 December 2021 for a description of the classes of securities of Azerion Group.

1. Excluding any conditional and unconditional option rights and Founder Warrants existing at the date of this press release, which in aggregate entitle the holders to receive up to a maximum of 24,160,245 Ordinary Shares. 2. The Ordinary Shares in treasury can be used for acquisitions, exercise of warrants and option rights and other general funding purposes.

3. The outstanding Warrants listed on Euronext Amsterdam at the date of this press release entitle the holders to receive up to 12,736,605 Ordinary Shares.

Immediately after completion of the business combination, the ownership percentages of Ordinary Shares are as follows:

Shareholder % Ordinary Shares⁴

Principion Holding B.V.⁵ 74.3%⁶

Azerion former depositary receipt holders 7.5%

Azerion former stock appreciation rights holders 4.0%⁷

Former EFIC1 converted special shares holders 5.9%

Other Shareholders 8.3%

Total 100.0%

Based on Azerion Group’s information. Actual share ownership percentages and regulatory filings and notifications of ownership percentages may differ.

4. Excluding treasury shares as well as any conditional and unconditional option rights and Founder Warrants existing at the date of this press release, which in aggregate entitle the holders to receive up to a maximum of 24,160,245 Ordinary Shares.

5. An entity controlled by Azerion’s co-founders and co-CEOs.

6. Including shares held for settlement of future acquisition-related earn out and other obligations. 7. Excluding shares held for settlement of future acquisition-related earn out and other obligations.

Atilla Aytekin, co-founder and co-CEO of Azerion says: “Today marks an important step for Azerion, and we are excited to finally enter the public markets and continue to grow and advance our platform whilst raising our profile amongst our customer and partner groups and talented workforce globally. We are proud to achieve this important milestone, and we look forward to our next growth phase and future

2

Public

as a public company. I am grateful to the entire Azerion team for all their hard work, which has brought us to this pivotal moment, and for the dedicated support of our partner EFIC1.”

Martin Blessing, former Chief Executive Officer of EFIC1, adds: “The journey of our SPAC EFIC1 comes to a successful end while the exciting journey of Azerion as a listed company starts now. The whole EFIC1 team thanks its shareholders for their support. We look forward to continuing our partnership with Azerion over the long term and wish the company, its founders, employees and shareholders success as they continue their impressive growth story.”

To celebrate the completion of the business combination, the management team of Azerion Group will ring the opening bell at Euronext Amsterdam at 09.00 CET on 2 February 2022. A live stream of the event and replay can be accessed via this link.

Advisers

Credit Suisse Bank (Europe), S.A. acted as capital markets adviser, Hogan Lovells International LLP acted as legal adviser and ABN AMRO Bank N.V acted as financial adviser to EFIC1.

N.M. Rothschild & Sons Limited acted as financial adviser, Stibbe N.V. acted as legal adviser, and Citigroup Global Markets Europe AG and Jefferies GmbH as capital markets advisers to Azerion.

ABN AMRO (acting in cooperation with ODDO BHF SCA), ING Bank N.V. and Pareto Securities AB acted as co-capital markets advisers to EFIC1, and Clifford Chance LLP acted as legal adviser to the capital markets advisers.

Liquidity Provider

As from 2 February 2022, Azerion Group will enter into a liquidity provider agreement pursuant to which ABN AMRO Bank N.V. will act as liquidity provider for the trade in listed shares of Azerion Group.

Latest News

SPOTLIGHT SPORTS GROUP AGREES NEW DEAL WITH HONG KONG JOCKEY CLUB

Spotlight Sports Group (SSG), a world-leading technology, content, and media company specialising in sports betting, has signed a deal to extend a multi-year agreement with the Hong Kong Jockey Club (HKJC).

The long-term partnership, powered by the Racing Post, will promote Hong Kong racing to a worldwide audience through the provision of full racecards for the Hong Kong Jockey Club meetings at Sha Tin and Happy Valley, editorial and tipping content. The partnership will also enable free-to-view live streams and replays of all Hong Kong racing via Racing Post digital platforms.

The collaboration also sees the promotion of the HKJC’s World Pool initiative, specifically with editorial, tipping and signposting of World Pool meetings. Spotlight Sports Group is delighted to have this agreement in place before Royal Ascot, a meeting that not only features high-class horse racing, but five days of World Pool betting.

James Fitzpatrick, Account Director for B2B Content Services at Spotlight Sports Group, said: “The Hong Kong Jockey Club is one of our key partners and I’m delighted we will be continuing our relationship. Extending this deal ahead of Royal Ascot will allow us to continue to promote World Pool days to a global audience during one of the biggest international meetings of the year.”

The view was shared by Michael Fitzsimons, Executive Director, Wagering Products of the HKJC: “The HKJC and Racing Post are two of the most powerful and respected brands in the horse racing industry and we can see many great opportunities to work together to achieve our goals and longer-term vision throughout the life of the agreement.”

Spotlight Sports Group aims to support the global betting, horse racing and fantasy sports industries.

The post SPOTLIGHT SPORTS GROUP AGREES NEW DEAL WITH HONG KONG JOCKEY CLUB appeared first on European Gaming Industry News.

Latest News

EGT’s Gods & Kings Link with first installation in Bulgaria

EGT’s jackpot Gods & Kings Link made its debut in Bulgaria. The first local gaming establishment to install the product is the largest casino in the country GoldenEye, located in Svilengrad.

“We are very happy to once again have the opportunity to support our partners from GoldenEye by providing them with one of the latest developments from our slot portfolio,” commented Biserka Draganova, Sales Manager for the Balkans and Egypt at EGT. “The fact that out of a total of 500 machines in the casino, 320 are EGT’s is a testament to the great confidence they have in us, and I believe that Gods & Kings Link will show the excellent results expected from it.”

The product is currently available on several cabinets of the G 50 J2 St model, and will be installed on more by the end of June. Gods & Kings Link has 4 levels of jackpot: Minor and Mini, that are fixed for each machine and Grand and Major, which are progressive and can be won with every bet made on any of the 4 games Rise of Ra, Olympus Glory, Ape of luck and Glorious Alexander. The Grand and Major levels are common with EGT’s bestseller jackpot Bell Link, thus creating even greater chances for wealth.

“Gods & Kings Link has definitely caught the attention of our customers and in the short period of time we’ve been offering it, we’ve seen a lot of interest in it,” said Mert Caliskan, Casino Operation Director. “The titles in the mix are extremely interesting and provide lots of bonuses and fun during play. This in combination with the possibility of getting even bigger winnings thanks to the connection to Bell Link, which is very popular in our casino, is a guarantee that this will be another very successful EGT product.”

The post EGT’s Gods & Kings Link with first installation in Bulgaria appeared first on European Gaming Industry News.

Latest News

Exciting Changes to the European Gaming Congress 2024: More Value for Operators & Affiliates!

HIPTHER is thrilled to announce a dynamic shift in focus for the upcoming European Gaming Congress (EGC) 2024, taking place in the vibrant city of Warsaw between 15-16 October! Our aim is to better serve our community of operators and affiliates by offering a richer, more diverse range of topics and panels.

While we will continue to provide critical insights with two compliance panels focused on Poland and the combined Nordic + D-A-CH regions, we are expanding our agenda to include exciting new topics that cater specifically to your interests and needs:

Esports: Exploring the rapidly growing world of competitive gaming and its integration with traditional gambling.

SEO: Strategies to optimize your online presence and drive more traffic to your platforms.

Marketing & PR: Innovative approaches to branding, customer engagement, and public relations in the gaming industry.

Fintech: Discovering the latest financial technologies transforming the gaming payment landscape.

Blockchain: Understanding how blockchain technology is revolutionizing transparency, security, and operations within gaming.

Special Offer: 30 Free Tickets for Affiliates and Operators!

To celebrate these exciting changes, we are offering 30 FREE TICKETS exclusively for affiliates and operators. This is your chance to gain invaluable knowledge, network with industry leaders, and stay ahead of the curve in the ever-evolving gaming landscape.

Don’t miss out! Secure your free ticket today and be part of the transformation at EGC 2024.

Claim Your Free Ticket Now: https://hipther.com/events/egc/freetickets-egc2024/

Join us in Warsaw for a groundbreaking event that promises to deliver unparalleled insights, innovative discussions, and exceptional networking opportunities. We look forward to welcoming you to the European Gaming Congress 2024!

Stay tuned for more updates and detailed agenda announcements.

The post Exciting Changes to the European Gaming Congress 2024: More Value for Operators & Affiliates! appeared first on European Gaming Industry News.

-

Latest News2 months ago

Latest News2 months agoCopenhagen Major 2024 – Betting Overview

-

Latest News2 months ago

Latest News2 months agoStakelogic’s Slot and Live Casino Content is now live with L&L Europe

-

Latest News3 months ago

Latest News3 months agoGameRefinery Expands Live Events Tracker to PC and Console, Offering Cross-Platform Insights

-

Latest News2 months ago

Latest News2 months agoEvoplay strikes distribution agreement with Light & Wonder

-

Latest News3 months ago

Latest News3 months agoCrown Approved to Retain its Melbourne Licence

-

Latest News3 months ago

Revenant Esports Adds ‘Punkk’ to Formidable BGMI eSports Lineup Ahead of the INR 2 Crore BGIS Tournament

-

Latest News3 months ago

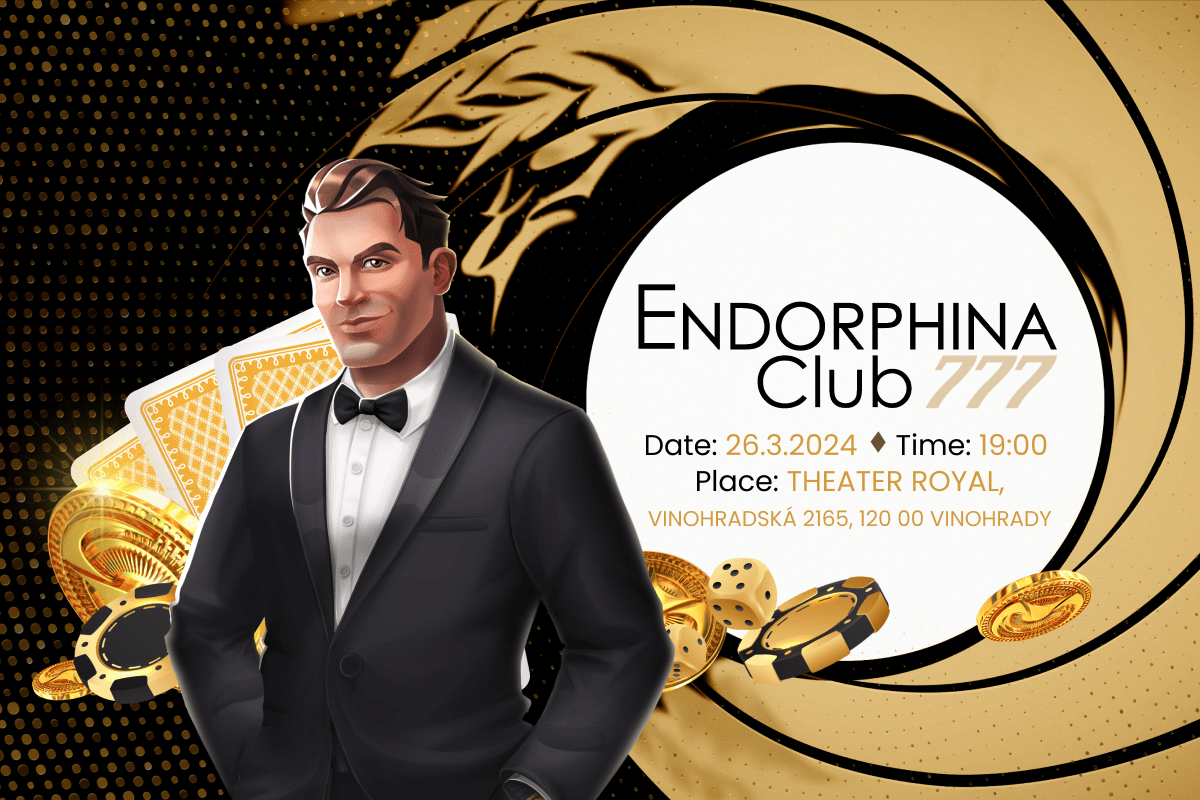

Latest News3 months agoExperience the red carpet glamour at the exclusive Endorphina Club Party!

-

Latest News2 months ago

These Are The Top Customer Acquisition Tactics for iGaming Startups

You must be logged in to post a comment Login