Latest News

Aspire Global Full Year and Fourth Quarter 2020 Results

Reading Time: 6 minutes

Reading Time: 6 minutes

RECORD HIGH REVENUES AND EBITDA IN Q4 AND FULL YEAR 2020

FOURTH QUARTER

- Revenues increased by 37.6% to €44.4 million (32.2).

- EBITDA increased by 89.9% to €8.3 million (4.4).

- The EBITDA margin increased to 18.6% (13.5%).

- EBIT increased by 100.4% to €6.3 million (3.1).

- Earnings after tax increased to €4.2 million (-11.6).

- Earnings per share, basic and diluted, amounted to €0.07 (-0.26).

- First time depositors (FTDs) increased by 0.3% to 105.9 thousand (105.6).

FULL YEAR

- Revenues increased by 23.2% to €161.9 million (131.4).

- EBITDA increased by 24.8% to €27.1 million (21.7).

- The EBITDA margin increased to 16.7% (16.5%).

- EBIT increased by 17.3% to €20.8 million (17.7).

- Earnings after tax increased to €15.0 million (1.9).

- Earnings per share, basic and diluted, amounted to €0.28 (0.01).

- First time depositors (FTDs) increased by 16.9% to 519.9 thousand (444.5).

SIGNIFICANT EVENTS IN THE QUARTER AND AFTER THE END OF THE QUARTER

- Revenues increased 37.6% from Q4 2019 driven by strong development in the B2B segment and acquisition of leading sportsbook provider BtoBet in September 2020.

- Organic growth of 30.8% from Q4 2019.

- B2B revenues grew 44.7% from Q4 2019 with an organic growth of 35.1%.

- Record high revenues and EBITDA in Q4 and full year 2020 driven by organic growth and acquisitions.

- In January total trading volumes increased to approximately €15.0 million, which is about 34% higher than the average monthly trading volume in Q1 2020.

- New markets entered – Spain, Russia and West Virginia.

- Pariplay’s games launched by Rush Street Interactive (RSI) in New Jersey.

- Partnerships in Latin America with William Hill and Betfair.

- Pay N Play solution launched and live with five operators.

- Repayment of bond due in April 2021 is secured. As a consequence of the repayment, the Board proposes to the AGM that no dividend is paid out for the financial year 2020. The Board is committed to the long-term dividend policy to distribute dividends annually in an amount of at least 50% of the Company’s net profits after taxes and expects to be able to propose a dividend for the financial year 2021.

| KEY FIGURES | ||||

| € million, unless other stated | FOURTH QUARTER | FULL YEAR | ||

| 2020 | 2019 | 2020 | 2019 | |

| Revenues | 44.4 | 32.2 | 161.9 | 131.4 |

| EBITDA | 8.3 | 4.4 | 27.1 | 21.7 |

| EBITDA margin, % | 18.6 | 13.5 | 16.7 | 16.5 |

| EBIT | 6.3 | 3.1 | 20.8 | 17.7 |

| EBIT margin, % | 14.2 | 9.8 | 12.9 | 13.5 |

| EPS, basic and diluted, € | 0.07 | -0.26 | 0.28 | 0.01 |

| Operating cash flow | 11.5 | -11.5 | 27.7 | 2.5 |

| Company hold, % | 46.6 | 49.6 | 48.1 | 52.0 |

| FTDs, thousand | 105.9 | 105.6 | 519.9 | 444.5 |

CEO COMMENTS

“OUR POTENTIAL FOR FURTHER GROWTH IS HUGE”

We have succeeded in establishing Aspire Global as a powerhouse for iGaming operators and see great opportunities for continued profitable growth. Our recent wins with tier 1 operators, our broad geographic footprint in four continents and outstanding offering provide us with a solid base for further expansion. In 2021, our top priorities are to roll out our sports offering in Europe, Africa and Latin America, and to certify the sports platform for future US deals. This will enable us to continue to grow our customer base with tier 1 operators and to build a strong market presence in the US.

Revenues were record high in the fourth quarter and increased by 37.6% to €44.4 million from Q4 2019 with good growth across all segments. The organic growth in the quarter amounted to 30.8% from Q4 2019. It’s promising to see the strong development for our games and sports offerings. Our subsidiaries for games and sports – Pariplay and BtoBet – both reported all time high revenues in the quarter. The B2C segment also reported a strong quarter with record high revenues, up 29.0% from Q4 2019.

IMPROVED PROFITABILITY

Profitability continued to improve steadily which demonstrates our ability to grow in locally regulated markets while maintaining good margins. EBITDA increased by 89.9% to €8.3 million from Q4 2019 and the EBITDA margin raised from 13.5% to 18.6%. This is a solid performance taking into account that the revenue share from taxed and locally regulated markets increased from 66% in Q4 2019 to 70% in Q4 2020.

BIG POTENTIAL IN SPORTS

The acquisition of the leading B2B sportsbook provider BtoBet in September has already turned out to be a strategic strength to us. Prior to the acquisition sports represented a minor part of Aspire Global’s revenues. With our new proprietary sportsbook we see fantastic growth opportunities in European markets such as Germany and the UK along with the US and Latin America. We have license application processes going on and we aim to introduce our proprietary sports offering in time for the European Championship in key markets.

During the quarter BtoBet has shown great success in signing tier 1 operators such as Betfair in Colombia and William Hill, also in Colombia. These partnerships in Latin America significantly strengthen our position in this big continent.

BREAKTHROUGHS IN THE US

The US market represents another important growth potential for Aspire Global. Pariplay – our leading game studio and games aggregator – recently announced its partnership for games with Rush Street Interactive (RSI), a market leader in online casino and sports betting in the US. RSI has already launched a selection of Pariplay’s high-quality online casino games in New Jersey which is a breakthrough for us into the regulated US market. In January, Pariplay received an interim iGaming supplier license for West Virginia, which marks another significant progress in the US.

We have high expectations for the US market and are building an organisation in the US to support Aspire Global’s expansion in this big market. As a first step, we are recruiting a managing director and a sales director for Aspire US. Aspire Global has also filed applications in Pennsylvania and Michigan with the objective to file in all accessible states. It’s an important advantage when we now address US operators that our complete iGaming offering includes the new sports platform.

ENTERING NEW MARKETS

In the quarter, Pariplay also made significant progress in Europe by entering new regulated markets. I’m happy to see Pariplay’s new partnership with 888casino in Portugal and Spain and how Pariplay further cemented its leading position in Switzerland by a deal with the market leader Swiss Casinos.

LEADING TECHNOLOGY

The Aspire Global technology has been developed throughout the years and we have gained deep knowledge of the complexities in the iGaming industry. We are not only technology experts; we are mastering the whole iGaming value chain. At Aspire Global, we combine broad industry experience with leading technology and knowledge in marketing as well as gaming behaviour and player protection.

In the quarter we launched our first Pay N Play operators in Finland which became an immediate success. We are already live with five operators and with the Pay N Play solution they now provide quicker registration, login and instant deposits and withdrawals.

We have also introduced Aspire Engage, the most advanced CRM tool in the market. In addition, our organisation has secured the needed adjustments in Germany, following the new regulations.

TIER 1 OPERATOR WINS

When summarizing the quarter, I would like to single out the tier 1 global operator wins as the most significant from a growth perspective. These deals prove that Aspire Global’s offering is competitive and best-in-class. I’m convinced that the significant partnerships with Rush Street Interactive (RSI), Betfair, William Hill and 888casino among all will open up for new opportunities on many other playing fields.

I’m also happy to see the energy and focus in the management team. In the quarter we have strengthened the team with top talents from the iGaming industry, namely Antoine Bonello from William Hill as COO and Paul Myatt as Chief Business Development Officer. Paul joined us from QuickSpin and has previous experience from among all NetEnt. Aspire Global’s previous COO Dima Reiderman has been appointed COO at BtoBet.

OUTLOOK

Over the past twelve months we have created a new Aspire Global and established the company as a powerhouse for iGaming operators. I dare to be bold and say that Aspire Global has unique assets that give the company a strong position with huge growth potential.

Prior to the acquisitions of BtoBet and Pariplay, Aspire Global was a European focused company with revenues mainly from casino. Today Aspire Global is present in four continents and we provide a complete, leading iGaming offering with proprietary games and games aggregation along with a sportsbook, gaming platform and managed services. This is key to our partners when they develop their expansion plans and provides us with competitive advantages.

The year 2021 has started in a good way and in January total trading volumes increased to approximately €15.0 million, which is about 34% higher than the average monthly trading volume in Q1 2020.

Finally, I would like to thank all my co-workers for the energy, passion and professionalism you have demonstrated during the challenging year with the pandemic. I look forward to continuing our inspiring work in realizing our vision to become the world’s leading iGaming supplier.

Tsachi Maimon

CEO

Latest News

Finland’s Gambling Reform Is Official – What Happens Next?

The wait is over: The Finnish Parliament has officially approved the new gambling legislation. In a decisive plenary session, MPs voted 158 in favor to 9 opposed, with 32 abstaining. The text remained unchanged from the version presented in previous weeks, solidifying the framework for Finland’s transition from a monopoly to a licensed market.

With the political uncertainty resolved, the focus now shifts to implementation. For operators, this means the race to compliance—and market entry—has effectively begun.

The Confirmed Timeline

With the legislation passed, the roadmap to the market opening is now set. Operators must use the coming months to prepare for a rigorous licensing process.

-

Early 2026: The application window is expected to open. The regulator will begin accepting and reviewing license applications.

-

2026 (Throughout): The “preparatory year.” This period is dedicated to vetting applicants, ensuring technical compliance, and establishing the new supervisory authority.

-

January 1, 2027: The regulated Finnish market officially opens. Licensed operators can go live with betting and online casino services.

Entering the Finnish Market with Nordic Legal

Navigating a new jurisdiction is complex, but it doesn’t have to be inefficient. With extensive experience advising on gaming licences across the Nordic markets, Nordic Legal brings a proven, practical approach to the Finnish process.

Efficiency Through Synergy If you already work with us in Denmark or Sweden, we ensure your Finnish licence application isn’t a “start from scratch” project. We build directly on our existing knowledge of your organisation and systems.

Your usual Nordic Legal contact will coordinate directly with our Helsinki team at no extra cost. This integrated approach saves you time and avoids the frustration of duplicating work you’ve already done for other Nordic licenses.

Our Approach We focus on smart compliance:

-

Reusing documentation where regulations overlap.

-

Anticipating regulatory questions before they are asked.

-

Aligning requirements for technical standards and responsible gambling.

-

Engaging constructively with the Finnish authority to ensure a smooth process.

The Finnish Licence Application Package

To support your entry, we offer a comprehensive package designed to handle the heavy lifting:

-

Translation of all required documents.

-

Guidance and completion of complex application forms.

-

Full project management from start to submission.

-

Direct communication with the Finnish regulator on your behalf.

Next Steps

The window for preparation is narrowing. Contact your usual Nordic Legal advisor today to discuss the new legislation or our Licence Application Package. Alternatively, reach out to us directly to secure your place in Finland’s upcoming regulated market.

The post Finland’s Gambling Reform Is Official – What Happens Next? appeared first on Gaming and Gambling Industry Newsroom.

Latest News

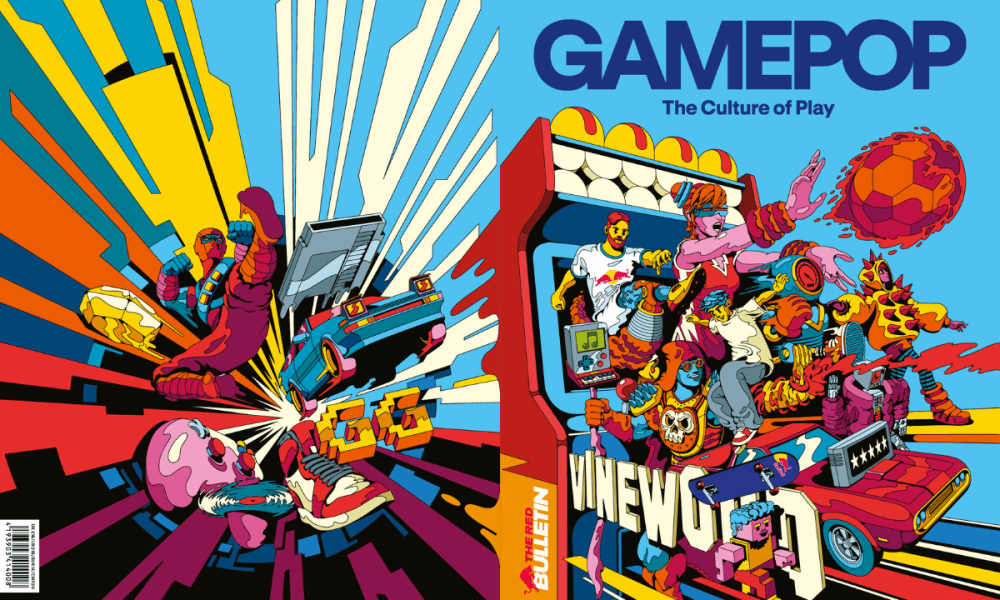

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News5 days ago

Latest News5 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login