Latest News

Scale isn’t everything: Why agility is the new advantage in live casino

Live casino’s rise has been meteoric, but the recent slowdown at the top end of the market suggests the next phase of growth won’t come from scale alone. As the sector matures, Ady Totah, CEO at LuckyStreak, explains why agility, hands-on management and a sharper product focus are fast becoming the new competitive edge.

There is a perception that the biggest live casino providers are the most capable. Is bigger always better?

It’s easy to assume that the biggest brands automatically deliver the best service, but with scale comes complexity. For larger organisations, adding new features or reacting to a regulatory update can take weeks or even months, especially when decisions span multiple time zones or teams have long approval chains.

At LuckyStreak, while we’re an established business with a large, dedicated workforce at our live dealer studio in Riga, our management team remains intentionally small and hands-on. In many ways, we operate more like a start-up, with fast, focused leadership at the core.

Myself and my co-founder Erez Cywier are closely involved in the day-to-day operations. This proximity shortens decision making processes, speeds up product assessments and empowers us to act quickly. We’re not tied down by long-winded protocols or bureaucracy.

A perfect example of this agility came when we saw an opportunity in the growing sweepstakes market. We already had the foundations but needed to adapt quickly. In just one quarter, we delivered compliant user interfaces, multi-coin virtual currency systems and configured both our own live games and third-party content to meet the unique needs of the sweepstakes audience. This is the kind of rapid pivot that is only possible when your decision-makers are hands-on.

How do boutique providers keep product planning sharp and strategic?

Knowing what matters and prioritising ruthlessly is what allows smaller providers to remain competitive in the market, when faced with more established, Tier 1 names. Speed, however, does not mean shortcuts.

We are sharpening our performance across the board and ensuring our roadmap gives us the flexibility to act when new opportunities arise. Effective product planning is all about focus. That means tuning out the industry noise, resisting trends for the sake of trends, and asking: what delivers real impact for our partners?

While some companies struggle under the weight of large and inflexible roadmaps, we have the luxury of being selective in what we build, and that makes our product roadmap more actionable, more tailored and therefore more valuable to our partners.

How can providers keep up with rising regulatory pressures?

Operating across multiple jurisdictions means navigating a complicated patchwork of compliance frameworks, licensing rules and technical standards quickly.

Compliance is not a support function, but a core part of the business. For larger businesses, these regulatory changes may present disruptions, but our size and structure allow us to react quickly and stay ahead of the curve, without compromising on quality.

To maintain both speed and quality, we moved from traditional Agile sprints to a continuous integration and deployment (CI/CD) model. Instead of bundling releases every two weeks, we push updates multiple times a week. This means we can react quickly to feedback, ship improvements faster, and keep our platform evolving without unnecessary delays.

Why is a more focused approach the future of live casino?

The criteria for what operators need from their live casino provider is changing. Reliability, flexibility, speed and compliance support are becoming just as, if not more, important than table count. We design everything with these qualities in mind, and we back that up with a strong culture of ownership and continuous delivery. This mindset allows us to innovate quickly, without sacrificing the robustness our partners expect.

In this new landscape, being lean, focused and responsive isn’t a limitation. In live casino, a genre requiring significant on-going operational investment, the providers that thrive are not always the biggest, but the smartest and the ones who can adapt fastest.

The post Scale isn’t everything: Why agility is the new advantage in live casino appeared first on European Gaming Industry News.

Latest News

Finland’s Gambling Reform Is Official – What Happens Next?

The wait is over: The Finnish Parliament has officially approved the new gambling legislation. In a decisive plenary session, MPs voted 158 in favor to 9 opposed, with 32 abstaining. The text remained unchanged from the version presented in previous weeks, solidifying the framework for Finland’s transition from a monopoly to a licensed market.

With the political uncertainty resolved, the focus now shifts to implementation. For operators, this means the race to compliance—and market entry—has effectively begun.

The Confirmed Timeline

With the legislation passed, the roadmap to the market opening is now set. Operators must use the coming months to prepare for a rigorous licensing process.

-

Early 2026: The application window is expected to open. The regulator will begin accepting and reviewing license applications.

-

2026 (Throughout): The “preparatory year.” This period is dedicated to vetting applicants, ensuring technical compliance, and establishing the new supervisory authority.

-

January 1, 2027: The regulated Finnish market officially opens. Licensed operators can go live with betting and online casino services.

Entering the Finnish Market with Nordic Legal

Navigating a new jurisdiction is complex, but it doesn’t have to be inefficient. With extensive experience advising on gaming licences across the Nordic markets, Nordic Legal brings a proven, practical approach to the Finnish process.

Efficiency Through Synergy If you already work with us in Denmark or Sweden, we ensure your Finnish licence application isn’t a “start from scratch” project. We build directly on our existing knowledge of your organisation and systems.

Your usual Nordic Legal contact will coordinate directly with our Helsinki team at no extra cost. This integrated approach saves you time and avoids the frustration of duplicating work you’ve already done for other Nordic licenses.

Our Approach We focus on smart compliance:

-

Reusing documentation where regulations overlap.

-

Anticipating regulatory questions before they are asked.

-

Aligning requirements for technical standards and responsible gambling.

-

Engaging constructively with the Finnish authority to ensure a smooth process.

The Finnish Licence Application Package

To support your entry, we offer a comprehensive package designed to handle the heavy lifting:

-

Translation of all required documents.

-

Guidance and completion of complex application forms.

-

Full project management from start to submission.

-

Direct communication with the Finnish regulator on your behalf.

Next Steps

The window for preparation is narrowing. Contact your usual Nordic Legal advisor today to discuss the new legislation or our Licence Application Package. Alternatively, reach out to us directly to secure your place in Finland’s upcoming regulated market.

The post Finland’s Gambling Reform Is Official – What Happens Next? appeared first on Gaming and Gambling Industry Newsroom.

Latest News

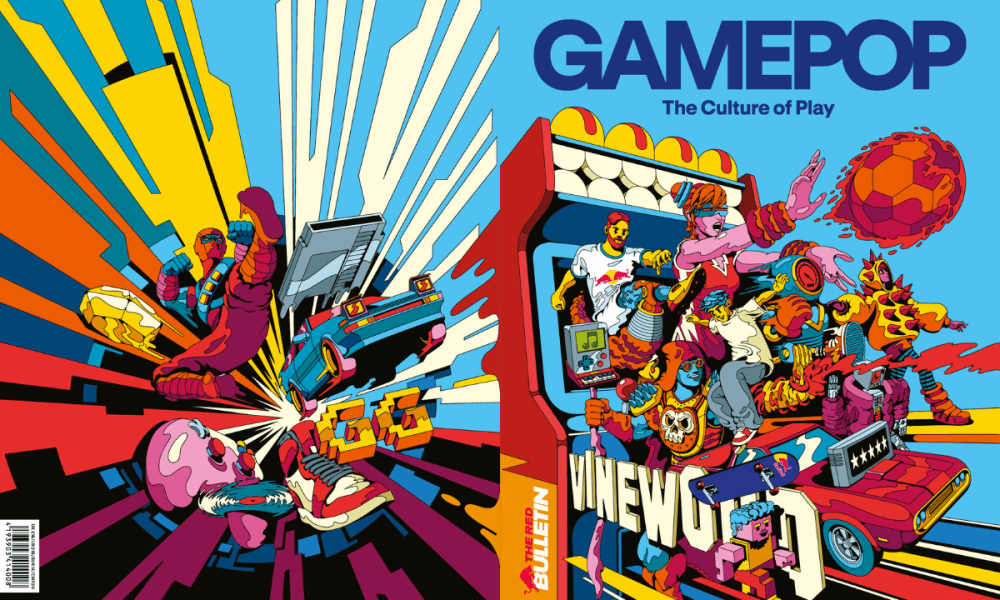

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News6 days ago

Latest News6 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login