Latest News

Brightstar Lottery Reports Second Quarter 2025 Results

Brightstar Lottery PLC has reported the financial results for the second quarter ended June 30, 2025.

“We achieved several important milestones over the last few months. We secured the Italy Lotto license through November 2034, closed the sale of our Gaming & Digital business for $4 billion in cash, and announced plans to return significant capital to shareholders. With a singular focus on lottery and unmatched industry expertise, we are well positioned to create value for all stakeholders with our mission to elevate lotteries and inspire players around the world,” said Vince Sadusky, CEO of Brightstar.

“Our second quarter results reflect sustained global demand for instant ticket and draw games. We are investing in key initiatives to drive sustainable, long-term growth, while also delivering structural cost reductions to right-size the business. The Company’s attractive profit profile and strong, predictable cash flows support our balanced approach to capital allocation,” said Max Chiara, CFO of Brightstar.

Key Highlights

• Successful completion of Gaming & Digital sale for approximately $4.0 billion of net cash proceeds on July 1, 2025.

• Secured several meaningful contract wins and extensions including a nine-year Lotto operator license in Italy, an eight-year contract in Missouri which includes a fully-integrated OMNIA retail and digital solution, and several multi-year instant ticket printing contract extensions.

• Expanding OPtiMa 3.0 cost reduction programme to $50 million to right-size the business following the Gaming & Digital sale.

Second Quarter 2025 Financial Highlights

Second quarter revenue was $631 million, up 3% or stable at constant currency.

• Instant ticket & draw same-store sales increased across geographies with Italy increasing 3.7%, U.S. higher by 0.6%, and Rest of World climbing 8.4%.

• Product sales rose 59% on higher instant ticket printing and terminal sales.

• Foreign currency translation had a positive impact on growth.

• Growth from the drivers above was partially offset by elevated U.S. multi-state jackpot activity and associated LMA incentives in the prior year.

Loss from continuing operations was $60 million compared to income from continuing operations of $84 million in the prior year period.

• Incurred a foreign exchange loss versus a foreign exchange gain in the prior year, primarily reflecting the non-cash impact of fluctuations in the EUR/USD exchange rate on debt.

• Operating income was lower, driven by the high profit flow-through from elevated U.S. multi-state jackpot sales and associated LMA incentives in the prior year and restructuring charges related to the expanded OPtiMa 3.0 cost reduction programme in the current year.

• Increased provision for income taxes.

• Dynamics noted above were partially offset by reduced interest expense.

Adjusted EBITDA was $274 million compared to $290 million in the prior-year period, demonstrating resiliency despite incremental investments in the business and multi-state jackpot and LMA dynamics.

• Prior year results include the high profit flow-through from elevated U.S. multi-state jackpot sales and associated LMA incentives.

• Selling, general, and administrative costs were modestly higher as ongoing investments in the business were partially offset by OPtiMa cost savings.

• The Q2’25 period benefited from positive foreign currency translation.

Diluted loss per share from continuing operations was $0.47 compared to diluted earnings per share from continuing operations of $0.21 in the prior year. Adjusted diluted earnings per share from continuing operations was $0.12 compared to $0.20 in the prior year, primarily driven by lower operating income.

YTD 2025 Financial Highlights

Year-to-date revenue of $1.2 billion compares to $1.3 billion in the prior-year period.

• The decline was due to higher U.S. multi-state jackpot activity and associated LMA incentives in the prior year.

• Global instant ticket & draw same-store sales rose 1.2%.

Loss from continuing operations was $52 million compared to income from continuing operations of $200 million in the prior year period.

• Lower operating income, primarily due to the items affecting Adjusted EBITDA as noted below.

• Foreign exchange loss versus foreign exchange gain in the prior year, primarily reflecting the non-cash impact of fluctuations in the EUR/USD exchange rate on debt.

Adjusted EBITDA of $524 million compares to $617 million in the prior-year, primarily driven by high profit flow-through from elevated U.S. multi-state jackpot sales and associated LMA incentives in the prior year, partially offset by positive foreign currency translation.

Diluted loss per share from continuing operations was $0.59 compared to diluted earnings per share from continuing operations of $0.56 in the prior year. Adjusted diluted earnings per share from continuing operations of $0.20 compares to $0.47 in the prior year primarily driven by lower operating income, partially offset by reductions in net interest and income tax expense.

Net debt was $5.2 billion compared to $4.8 billion at December 31, 2024. The increase was primarily driven by an approximate $340 million impact from fluctuations in the EUR/USD exchange rate. Net debt leverage was 3.0x pro forma for $2 billion debt reduction completed in July.

Cash and Liquidity Update

Total liquidity was $2.9 billion as of June 30, 2025 with $1.3 billion in unrestricted cash and $1.6 billion in additional borrowing capacity from undrawn credit facilities.

Other Developments

The Company plans to launch a $250 million accelerated share repurchase programme (ASR) by entering into an accelerated share repurchase agreement with a counterparty bank. The Company plans to execute the ASR as part of its $500 million share repurchase authorization outlined below and in accordance with the share repurchase authorisation provided by the Company’s shareholders at the Company’s 2025 Annual General Meeting. The Company has been informed by De Agostini S.p.A., that it does not intend to participate in the ASR.

The Company’s Board of Directors declared a quarterly cash dividend of $0.20 per common share with a record date of August 12, 2025 and a payment date of August 26, 2025.

Completed the sale of the Gaming & Digital business on July 1, 2025. The Company received approximately $4.0 billion of net cash proceeds that are expected to be allocated in the following manner:

$2.0 billion used to reduce debt (completed in July 2025).

• Redeemed in whole the 4.125% Senior Secured U.S. Dollar Notes due April 2026 and the 3.500% Senior Secured Euro Notes due June 2026.

• Prepaid €300 million of the Term Loan Facilities due January 2027.

• The remaining amount was allocated to prepay the Revolving Credit Facilities due July 2027.

$1.1 billion to be returned to shareholders.

• The Company’s Board of Directors declared a special cash dividend to common shareholders in the amount of $3.00 per share. The record date of the distribution was July 14, 2025, and it is payable July 29, 2025.

• In addition, the Board authorized a $500 million, two-year share repurchase programme. The new authorisation replaces the Company’s existing share repurchase programme.

$500 million to partially fund upcoming Italy Lotto license payments.

$400 million to be used for general corporate purposes.

The U.S. federal income tax consequences of distributions by the Company will depend, in part, on whether the Company has current or accumulated earnings and profits (“E&P”), as determined under U.S. federal income tax principles. Based on preliminary estimates, the Company does not expect to have current E&P for fiscal year 2025 or accumulated E&P from prior fiscal years that would offset the current year expected E&P deficit. Accordingly, the Company anticipates that the special dividend, the Q1 dividend paid on June 12, and any future dividends paid in the current fiscal year will be treated for U.S. income tax purposes as a non-taxable return of capital to the extent of a shareholder’s basis in its shares, and thereafter as capital gain, although no assurances can be provided because the determination of E&P is a full-year calculation which depends upon facts that are not known as of the date hereof.

FY’25 Outlook: Adjusted EBITDA Reaffirmed, Cash Flow Improved

• Revenue of approximately $2.50 billion; adjusting revenue down $50 million compared to the previous outlook to reflect a timing shift in product sales and increased amortization related to Italy Lotto upfront license fee (which is treated as contra-revenue).

• Adjusted EBITDA of approximately $1.10 billion, in line with the previous outlook as incremental benefit from foreign currency translation is offset by higher-than-expected U.S. multi-state jackpot and LMA impacts.

• Net cash used in operating activities of approximately $275 million reflects a $75 million improvement versus the previous outlook driven by interest, income taxes, and other working capital items.

• Capital expenditures of approximately $375 million, a $75 million improvement from the previous outlook to reflect timing shifts related to recent contract extensions.

• Increasing FY’25 EUR/USD assumption to 1.12.

The post Brightstar Lottery Reports Second Quarter 2025 Results appeared first on European Gaming Industry News.

Latest News

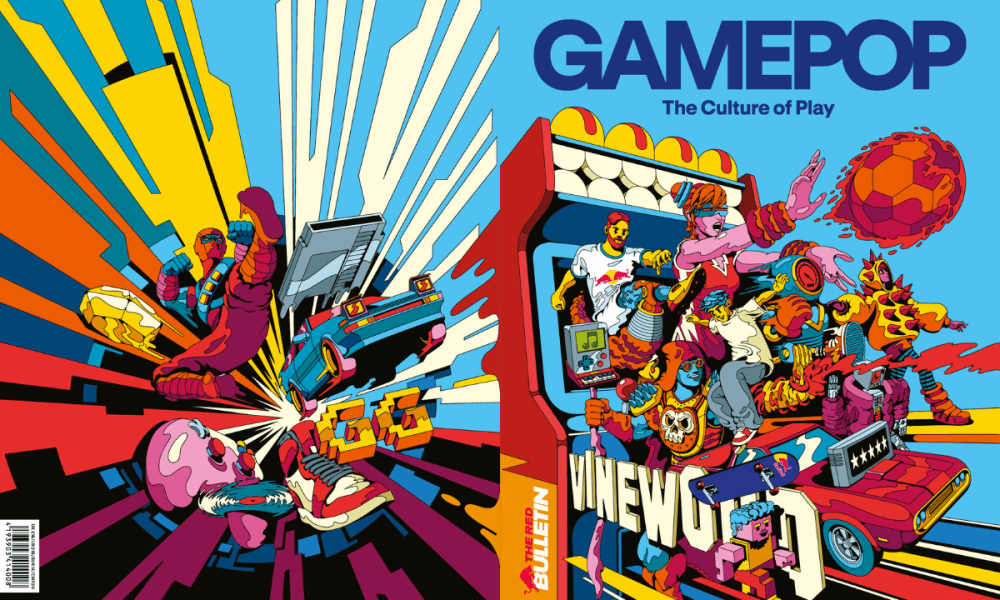

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

Latest News

White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia

Partnership sees leading branded content and popular Jackpot Royale integrated into Delaware North’s Betly online casino in the Mountain State

White Hat Studios, the “House of Brands” provider to the United States iGaming market, has partnered with Delaware North to launch on its Betly mobile sportsbook and casino in West Virginia.

The leading provider aims to build its online casino offering with the addition of the industry’s top-performing games.

Betly players in West Virginia will now have access to White Hat Studios’ acclaimed portfolio of premium branded titles, including Ted, The Goonies, and the award-winning 7s Fire Blitz series.

Also included in the rollout are the popular Jackpot Royale and Jackpot Royale Express progressive jackpot networks, currently live across more than 40 titles, and the first Betly-branded iCasino game – Betly Player’s Choice Blackjack.

Designed to elevate player engagement and boost retention, the addition of these promotional tools adds another layer of excitement to the Betly casino offering.

White Hat Studios has made significant strides in its U.S. growth trajectory since launching in 2021, consistently delivering high-performing content across multiple states. West Virginia remains a key market for the provider, following its remarkable success in all seven regulated U.S. iGaming states.

The collaboration represents another major step in White Hat Studios’ expansion across regulated U.S. states and reinforces its reputation as a go-to content partner for forward-thinking operators.

Daniel Lechner, SVP Sales and Marketing at White Hat Studios, said: “We’re thrilled to be partnering with Delaware North on the Betly online casino app in West Virginia.

“This partnership reflects our ongoing commitment to delivering top-tier content quickly and seamlessly to operators across the U.S. With our portfolio of fan-favorite branded titles and innovative features like Jackpot Royale, we’re confident we’ll make an immediate impact for Betly and its players.”

Bob Akeret, General Manager for Betly, added: “We’re excited to welcome White Hat Studios onto our Betly platform in West Virginia. Their reputation for delivering engaging, high-quality games, especially branded content, makes them an ideal partner as we continue to elevate our casino experience.”

The post White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News5 days ago

Latest News5 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login