Latest News

Modern Oracles & Smart Payments: Finrax’s Vision for Blockchain, AI & Beyond

Finrax steps into the spotlight as the official Lanyards Sponsor at HIPTHER’s MARE BALTICUM Gaming & TECH Summit 2025 in Vilnius, bringing with them a next-gen crypto payment gateway and a bold vision that extends far beyond payments.

We sat down with Konstantinas Balakinas, CEO of Finrax, to discuss the future of AI in finance, the real-world potential of blockchain beyond the buzzwords, and how Finrax plans to bridge fintech innovation with eCommerce and beyond.

Konstantinas, thank you for joining us! Can you please introduce yourself to our readers, and share more about your professional background and role in Finrax?

Thank you — it’s a pleasure to be part of this conversation, especially as Finrax steps into a more visible role at this year’s summit.

I’ve been working in the financial industry since 1999, mostly in regulated environments. The bulk of my career has been in consumer finance, where I had the chance to grow several companies from the ground up and eventually guide one through the process of securing a specialized bank license. That experience taught me a lot about how to build resilient financial infrastructure — and how to adapt when the rules, tools, and expectations shift.

My interest in AI came later. I had a first-hand look at its practical impact while working with a Lithuanian EMI that was really leaning into AI-driven operations. That sparked something — and eventually led me to study AI for Business Analytics at Turing College, where I’m currently sharpening both technical and strategic understanding of how AI can reshape financial services.

At Finrax, I serve as CEO and Chair of the Management Board in its Lithuanian entity. Our mission goes beyond crypto payments — we’re focused on building real utility for digital assets in a way that businesses can trust and adopt without friction.

How do you see today’s AI solutions? Can they be truly predictive, like “modern oracles”, or are we still in the realm of reactive technology?

AI today is generative AI — especially large language models (LLMs), which have made impressive progress in producing human-like text and anticipating user intent. So in a technical sense, yes — these systems are predictive, but not in the way many assume. What they predict is not the future itself, but the next statistically likely word or phrase based on patterns learned from massive datasets. That creates the appearance of intelligence, but not true comprehension.

This distinction is essential. As Carl Bergstrom and Jevin West explain in The Bullshit Machines, LLMs can sound coherent and authoritative while having no actual grasp of truth. They generate content that feels convincing, regardless of whether it’s accurate or logically sound. That’s not a flaw — it’s how they’re designed.

One should approach these tools with both optimism and caution. Today’s AI still sits within the boundaries of Artificial Narrow Intelligence — excellent at specific tasks like pattern recognition, anomaly detection, and content generation, but still a long way from Artificial General Intelligence, which would reason and adapt like a human across any domain. And Artificial Superintelligence, capable of recursive self-improvement and independent thought, remains firmly theoretical.

So, while we admire the capabilities of today’s generative AI, we don’t mistake fluency for understanding. These are powerful tools — but not oracles. The real challenge is using them responsibly and building systems around them that make sense in the real world.

What are some practical ways AI is and could be integrated into Finrax’s crypto payment platform? Are there use cases you’re already exploring or see as promising?

I see three core domains where AI tools offer real practical value — not just for Finrax, but for any fintech building towards efficiency, scale, and regulatory clarity.

The first is internal productivity. AI works well as a personal assistant for employees — helping with everything from drafting emails to summarizing documents or generating code. Off-the-shelf tools like ChatGPT are already useful for this, but their impact depends heavily on how well people know how to prompt them. That’s why custom GPTs are especially promising: they allow us to build tailored assistants with topic-specific knowledge and clear task guidance. For instance, an onboarding specialist might use one to walk through a compliant KYC checklist, while a developer could use another to generate smart contract boilerplate or debug Python scripts.

The second domain is AI agents — and this space is moving fast. These systems handle automated, rule-based workflows, often collaborating with other agents to move tasks along. They’re more constrained than LLMs, but more reliable when used within predefined rules. For a crypto payment platform like ours, agents could eventually assist in payment routing, compliance alerts, or even technical monitoring — anything repetitive that benefits from low-latency automation.

The third area is pattern recognition, where AI’s value is most proven. We see strong potential in using it to support fraud detection and ML/TF screening — not to replace human oversight, but to enhance it. Spotting unusual activity, flagging anomalies, or refining transaction scoring — these are all areas where AI can quietly but meaningfully improve risk management.

That said, we’re also realistic about the limits. With the EU AI Act now on the horizon, every integration has to pass the test of explainability, compliance, and accountability. Any system we deploy will need a clear inventory, GDPR alignment, risk assessment, and, in some cases, staff training. We’re already looking into how these rules will apply — especially as we explore the potential of agent-based systems.

So yes, we’re enthusiastic — but we’re moving deliberately. We’re not building AI from scratch, but we are actively exploring how to apply it in meaningful ways — both internally and within our services. Our business development team is already using tools like ChatGPT in their day-to-day work, and we see real gains in productivity and clarity. That’s the direction we’re leaning into: using AI where it helps people do their jobs better, not just to check a box.

Finrax has built a strong reputation for reliability and speed – processing crypto payments in under a minute. What differentiates your platform from other solutions currently available on the market?

Reliability is the real star here. Speed is expected in blockchain-based systems — but combining that speed with stability, predictability, and regulatory clarity is a much harder problem to solve. That’s exactly where Finrax delivers.

We’ve built a platform that doesn’t just move fast — it does so in a way businesses can actually depend on. We offer fixed-rate settlements to remove volatility, giving partners certainty about what they’ll receive. That’s especially important in high-volume environments, where financial precision matters just as much as transaction speed.

Compliance is also baked in. Every transaction goes through full AML/CTF screening, and our onboarding and monitoring standards are designed to meet the expectations of regulated businesses. That’s not a side feature — it’s part of our foundation.

And while many of our clients have international operations, we’re careful to operate only where we’re permitted to do so. With MiCA coming into force, we’re preparing to scale responsibly, aligned with the new rulebook.

So yes, we’re fast — but more importantly, we’re reliable. And in this space, that’s what truly sets us apart.

What opportunities do you see in the field of eCommerce for a crypto-first payment provider, and what role could Finrax play in shaping the future of online payments?

Crypto is here to stay — and with that in mind, we’re building the tools to help eCommerce businesses accept crypto as naturally as they would any traditional payment method. Our goal at Finrax is to provide plug-and-play solutions that allow online stores across the EU to accept payments in stablecoins or major cryptocurrencies without having to rethink their entire checkout process.

The opportunity goes beyond retail. We see strong potential in industries like logistics, aviation, luxury, and of course, gaming platforms — areas where cross-border payments, speed, and transparency really matter. That said, everything still depends on how quickly users adopt crypto in their day-to-day transactions.

What gives us optimism is the direction regulation is moving. With MiCA coming into effect in the EU, we’re finally getting a clear rulebook — and that’s exactly what’s needed to build trust. Once customers know that only licensed, properly regulated providers can offer these services, it changes the perception. It brings structure to the market — and with structure comes wider adoption.

At Finrax, we’re preparing for that shift. We don’t just want to be ready for the future of payments — we want to help shape it in a way that’s both efficient and trusted.

As the world becomes increasingly automated, how do you see Finrax maintaining a balance between innovation and user-centric service, especially amidst the fast-evolving tech and regulatory landscapes?

Automation, at its core, is about efficiency — but that doesn’t mean we lose sight of the human side. In fact, I’d argue that smart automation should strengthen customer-centricity, not weaken it.

At Finrax, we see automation as a way to free up our people to focus on what actually matters — understanding the client’s real needs, solving problems, and making sure the experience feels consistent and supportive across the board. It also helps us align internal processes more clearly, so that we’re not sending mixed messages to clients. That’s often where customer frustration begins — not with the technology, but with the gaps between systems and people.

Another benefit is the ability to understand customers more precisely. With better data and well-designed workflows, we can respond faster and more accurately, without adding friction.

But none of this can come at the expense of trust. As regulations like MiCA, GDPR, and the EU AI Act begin shaping the environment, it’s clear that automation must be explainable, compliant, and ethically sound. For us, innovation isn’t just about what’s possible — it’s about what’s responsible. And we see that as a competitive advantage, not a constraint.

You’ll be joining the panel “Beyond the Hype” at MARE BALTICUM, discussing blockchain and AI applications in finance and governance. What are you most looking forward to sharing with the audience – and what do you hope to take away from the conversation?

A lot of the hype around AI comes from not really understanding how it works — and I think it’s important to go back to the basics. Most people still assume these systems “know” things. But in reality, large language models are built by training on massive volumes of data — much of it containing human bias, errors, or even outright misinformation. They don’t reason. They predict. They break down language into tokens and map those tokens across hundreds of abstract dimensions — far beyond how we perceive space — then generate output that mimics meaning, even if it’s not grounded in real understanding. But it’s not grounded in fact unless you make it so.

Even the best models will produce an answer to almost anything — even if that answer is fabricated. That’s why we see hallucinations. Unless you know how to prompt properly and critically assess the output, the result might sound confident while being completely off. This is why I always say: at this stage, AI should be seen as an assistant, not an authority. The human must remain in the loop — and at the top.

That said, the future isn’t bleak — it’s exciting, if we use these tools responsibly. One example that stands out to me is what Stripe recently did. They trained an AI model not on words or code, but on tens of billions of payment transactions. The model learned the “language” of money — identifying how payments behave, how fraud patterns look, and what hidden connections exist between different data points. The result? They went from detecting 59% of sophisticated card testing fraud attempts to 97% — almost overnight. That’s not just a technical win — it’s a complete shift in how we think about structured financial data.

So on this panel, I’m hoping to bring two things to the table: first, a grounded reminder that no model is infallible, and second, a practical optimism. AI has the potential to make finance faster, smarter, and safer — but only if we stay thoughtful about how we design, train, and regulate it. Humans should come first — but we don’t need to fear the future if we build it wisely.

Meet Konstantinas Balakinas and the Finrax team live at the MARE BALTICUM Gaming & TECH Summit 2025 on 27–28 May in Vilnius.

🔗 Register now to learn more about blockchain-powered finance, crypto innovation, and the real tech shaping tomorrow’s payments.

The post Modern Oracles & Smart Payments: Finrax’s Vision for Blockchain, AI & Beyond appeared first on European Gaming Industry News.

Latest News

Finland’s Gambling Reform Is Official – What Happens Next?

The wait is over: The Finnish Parliament has officially approved the new gambling legislation. In a decisive plenary session, MPs voted 158 in favor to 9 opposed, with 32 abstaining. The text remained unchanged from the version presented in previous weeks, solidifying the framework for Finland’s transition from a monopoly to a licensed market.

With the political uncertainty resolved, the focus now shifts to implementation. For operators, this means the race to compliance—and market entry—has effectively begun.

The Confirmed Timeline

With the legislation passed, the roadmap to the market opening is now set. Operators must use the coming months to prepare for a rigorous licensing process.

-

Early 2026: The application window is expected to open. The regulator will begin accepting and reviewing license applications.

-

2026 (Throughout): The “preparatory year.” This period is dedicated to vetting applicants, ensuring technical compliance, and establishing the new supervisory authority.

-

January 1, 2027: The regulated Finnish market officially opens. Licensed operators can go live with betting and online casino services.

Entering the Finnish Market with Nordic Legal

Navigating a new jurisdiction is complex, but it doesn’t have to be inefficient. With extensive experience advising on gaming licences across the Nordic markets, Nordic Legal brings a proven, practical approach to the Finnish process.

Efficiency Through Synergy If you already work with us in Denmark or Sweden, we ensure your Finnish licence application isn’t a “start from scratch” project. We build directly on our existing knowledge of your organisation and systems.

Your usual Nordic Legal contact will coordinate directly with our Helsinki team at no extra cost. This integrated approach saves you time and avoids the frustration of duplicating work you’ve already done for other Nordic licenses.

Our Approach We focus on smart compliance:

-

Reusing documentation where regulations overlap.

-

Anticipating regulatory questions before they are asked.

-

Aligning requirements for technical standards and responsible gambling.

-

Engaging constructively with the Finnish authority to ensure a smooth process.

The Finnish Licence Application Package

To support your entry, we offer a comprehensive package designed to handle the heavy lifting:

-

Translation of all required documents.

-

Guidance and completion of complex application forms.

-

Full project management from start to submission.

-

Direct communication with the Finnish regulator on your behalf.

Next Steps

The window for preparation is narrowing. Contact your usual Nordic Legal advisor today to discuss the new legislation or our Licence Application Package. Alternatively, reach out to us directly to secure your place in Finland’s upcoming regulated market.

The post Finland’s Gambling Reform Is Official – What Happens Next? appeared first on Gaming and Gambling Industry Newsroom.

Latest News

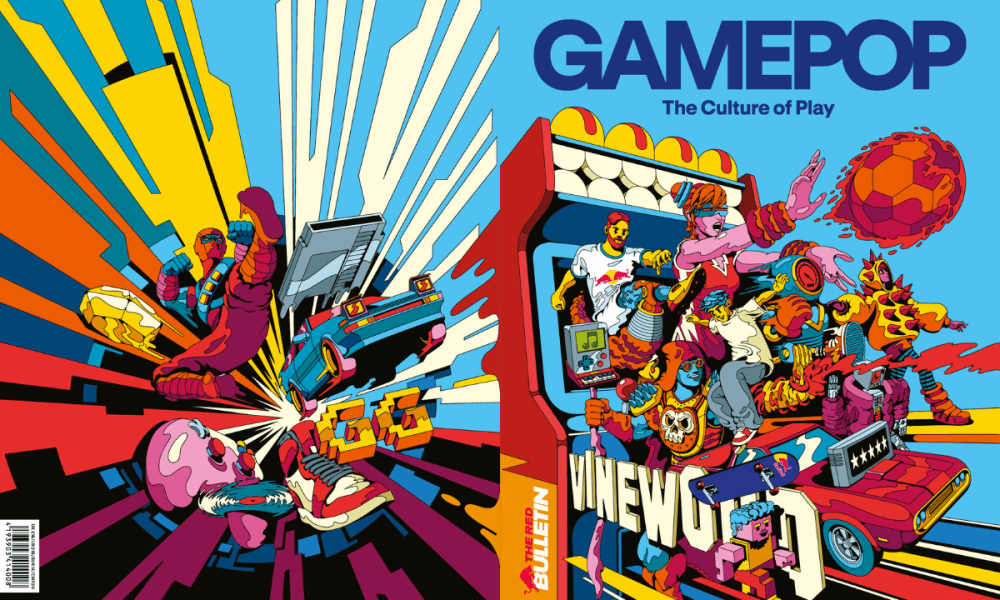

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News6 days ago

Latest News6 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login