Latest News

Notice of Kambi Group Plc Annual General Meeting 2025

NOTICE IS HEREBY GIVEN that that THE ANNUAL GENERAL MEETING (the “Meeting”) of Kambi Group plc, company number C 49768 (the “Company”), will be held on Monday 19 May 2025 at 13.00 CEST at Avenue 77 Complex, A4, Triq in-Negozju, Zone 3, Central Business District, Birkirkara, CBD 3010, Malta, to consider the following Agenda. The registration of shareholders starts at 12.30 CEST.

Right to attendance and voting

- To be entitled to attend and vote at the Meeting (and for the purpose of the determination by the Company of the number of votes that may be cast), shareholders must be entered on the Company’s register of members maintained by Euroclear Sweden AB by Friday 25 April 2025.

- Shareholders whose shares are registered in the name of a nominee should note that they may be required by their respective nominee(s) to temporarily re-register their shares in their own name in the register of members maintained by Euroclear Sweden AB in order to be entitled to attend and vote (in person or by proxy) at the Meeting. Any such re-registration would need to be effected by Friday 25 April 2025. Shareholders should therefore liaise with and instruct their nominees well in advance thereof.

- To be entitled to attend and vote in person at the Meeting, shareholders must notify Euroclear Sweden AB of their intention to attend the Meeting by Friday 25 April 2025 and can do so by (i) e-mail to [email protected] or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE- 101 23 Stockholm, Sweden or (iii) phone on +46 8 402 9092 during the office hours of Euroclear Sweden AB. Notification should include the shareholder’s name, address, email address, daytime telephone number, personal identification number/company registration number (or similar), number of shares held in the Company, as well as details of any proxies (if applicable, in the case that the shareholder has appointed a third party representative to attend the Meeting in its stead). Information submitted in connection with the notification will be computerised and used exclusively for the Meeting. See below for additional information on the processing of personal data.

Shareholders’ right to appoint a proxy

- A shareholder who is entitled to attend and vote at the Meeting is entitled to appoint one or more proxies to attend and vote on his or her behalf. A proxy need not also be a shareholder. If the shareholder is an individual, the proxy form must be signed by the appointer (or his authorised attorney) and comply with article 131 of the Articles. If the shareholder is a corporation, the proxy form must be signed on its behalf by an authorised attorney or a duly authorised officer of the corporation and comply with article 131 of the Articles.

- Proxy forms must clearly indicate whether the proxy is to vote in his/her discretion or in accordance with the voting instructions sheet attached to the proxy form. If the proxy form is returned to the Company with the voting instructions completed, the proxy shall vote as the shareholder has directed in respect of the resolutions set out in this notice or on any other resolution that is properly put to the Meeting. If the proxy form is returned to the Company without any indication as to how the proxy shall vote, generally or in respect of a particular resolution, the proxy shall exercise his/her discretion as to how to vote or whether to abstain from voting, generally or in respect of that particular resolution (as applicable).

- Where the shareholder is a corporation, a document evidencing the signatory’s authority to sign the proxy form must be submitted with the proxy form. Where the proxy form is signed on behalf of the shareholder by an attorney (rather than by an authorised representative, in the case of a corporation), the original power of attorney or a copy thereof certified or notarised in a manner acceptable to the Board of Directors (the “Board”) must be submitted to the Company, failing which the appointment of the proxy may be treated as invalid.

- The original signed proxy form and, if applicable, other supporting documents (required pursuant to the above instructions), must be received by Euroclear Sweden AB no later than Friday 25 April 2025 by (i) e-mail to [email protected] or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE- 101 23 Stockholm, Sweden. Shareholders are therefore encouraged to submit their proxy forms (and other applicable supporting documents, if any) as soon as possible.

- Proxy forms are available on the Company’s website under the General Meetings section.

- Aggregated attendance notifications and proxy data processed by Euroclear Sweden AB must be transmitted to and received by the Company by email at [email protected] not less than 48 hours before the time appointed for the Meeting in order to be treated as valid.

Agenda

1. Opening of the Meeting

2. Election of Chairperson of the Meeting

3. Drawing up and approval of the voting list

4. Approval of the Agenda

5. Determination that the Meeting has been duly convened

6. Election of two persons to approve the minutes of the Meeting

7. Presentation of the Annual Report and the Financial Statements of the Company for the year ended 31 December 2024 and the Reports of the Directors and Reports of the Auditors thereon

8. CEO’s presentation

Ordinary Business (Ordinary Resolutions)

9. To receive and approve the Annual Report and the Financial Statements of the Company (both individual and consolidated) for the year ended 31 December 2024 and the Reports of the Directors and Reports of the Auditors thereon (Resolution A)

10. To approve the remuneration report set out on page 50 of the Company’s Annual Report and on the consolidated Financial Statements for the year ended 31 December 2024 (Resolution B)

11. To determine the number of Board members as seven (Resolution C)

12. To determine the Board members’ fees (Resolution D)

13. To re-elect Anders Ström as a Director of the Company (Resolution E)

14. To re-elect Patrick Clase as a Director of the Company (Resolution F)

15. To re-elect Marlene Forsell as a Director of the Company (Resolution G)

16. To re-elect Kristian Nylén as a Director of the Company (Resolution H)

17. To re-elect Benjamin Cherniak as a Director of the Company (Resolution I)

18. To appoint Anna Nordell Westling as a Director of the Company (Resolution J)

19. To appoint Ronnie Bodinger as a Director of the Company (Resolution K)

20. To appoint Anders Ström as the Chairperson of the Board (Resolution L)

21. To approve the guidelines for how the Nomination Committee shall be appointed (Resolution M)

22. To re-appoint Mazars as Auditors of the Company, represented by Anita Grech, and to authorise the Directors to determine the Auditors’ remuneration. (Resolution N)

Special Business (Extraordinary Resolutions)

23. In accordance with articles 85(1) and 88(7) of the Companies Act (Chapter 386 of the Laws of Malta, the “Companies Act”), and article 2 of the Articles of Association, to authorise and empower the Directors, on one or several occasions prior to the date of the next Annual General Meeting of the Company, to issue and allot up to a maximum of 2,990,362 Ordinary shares in the Company of a nominal value of €0.003 each (corresponding to a dilution of approximately 10% of total shares as at the date of the notice to the 2025 Annual General Meeting) for payment in kind or through a direct set-off in connection with an acquisition, and to authorise and empower the Directors to restrict or withdraw the right of pre-emption associated with the issue of the said shares. This resolution is being taken in terms and for the purposes of the approvals required by the Companies Act and the Articles of Association. (Resolution O)

24. In accordance with articles 85(4) and 88(7) of the Companies Act and article 9 of the Articles of Association, to authorise and empower the Directors with immediate effect and on one or several occasions during a period of 5 years from the date of this resolution, to issue options to be allotted with Ordinary shares in the Company having a nominal value of €0.003 each, up to the equivalent of 5% of the issued Ordinary Shares of the Company from time to time, solely for the purpose of issuing such shares to holders (if any) or future holders of options under the Kambi Group plc Share Option Plan 2025 as may from time to time be approved by the Directors for this purpose, without first offering the said options and the shares subject thereto to existing members of the Company. This resolution is being taken in terms and for the purposes of the approvals required by the Companies Act and the Articles of Association. (Resolution P)

25. WHEREAS at a meeting of the Board of the Company held on 09 April 2025, the Directors resolved to obtain authority to buy back Ordinary shares in the Company having a nominal value of €0.003 each; and

WHEREAS pursuant to article 4 of the Articles of Association and article 106(1) (b) of the Companies Act, the Company may acquire any of its own shares otherwise than by subscription, provided inter alia that authorisation is given by an extraordinary resolution determining the terms and conditions of such acquisitions, in particular the maximum number of shares to be acquired, the duration of the period for which the authorisation is given and the maximum and minimum consideration.

NOW THEREFORE, the Board proposes that the shareholders adopt the following extraordinary resolution:

(i) To authorise the Company to make purchases of Ordinary shares in the Company of a nominal value of €0.003 each in its capital, subject to the following:

(a) the maximum number of shares that may be so acquired is 2,990,362, which is equivalent to approximately 10% of total shares as of the date of the notice to the 2025 Annual General Meeting;

(b) the minimum price that may be paid for the shares is SEK1 per share;

(c) the maximum price that may be paid for the shares is SEK1,000 per share;

(d) the maximum aggregate number of shares that can either i) be issued and allotted under Resolution O and ii) bought back under this Resolution Q shall not exceed 2,990,362; and

(e) the authority conferred by this resolution shall expire on the date of the 2026 Annual General Meeting and in no case shall exceed the period of 18 months, but not so as to compromise the completion of a purchase contracted before such date.

(ii) To empower the Board of Directors to cancel, at any time, any such shares acquired pursuant to this resolution and all other shares previously acquired by the Company. (Resolution Q)

26. WHEREAS the Board is proposing certain amendments to the current Memorandum and Articles of Association of the Company; and

WHEREAS a marked-up version of the current Memorandum and Articles of Association of the Company, showing all the amendments being proposed by the Board, is available on the Company’s website under the General Meetings section.

NOW THEREFORE, the Board proposes that the shareholders adopt the following extraordinary resolution:

(i) That all amendments proposed to be made to the Company’s current Memorandum and Articles of Association (the “Current M&As”) be approved, and that the Current M&As be substituted in their entirety by the updated Memorandum and Articles of Association in the form, or in substantially the same form, as that made available on the Companys’ website pursuant to, and as at the date of, the notice to the 2025 Annual General Meeting (the “Revised M&As”); and

(ii) To authorise the Board of Directors to give full effect to all matters duly resolved upon herein, and for this purpose, to:

(a) issue a certified extract of this resolution;

(b) file the Revised M&As and the aforementioned extract with the Malta Business Registry, and/or any other competent authority, as may be required in terms of law; and

(c) generally, to take any and all appropriate action as may be necessary and execute any and all such documents that may be required, desirable and/or conducive to give full effect to this resolution, and to register the abovementioned changes, as applicable, with the relevant authorities. (Resolution R)

27. Subject to the passing of Resolution R, and without prejudice to Resolution Q:

(i) To authorise the Company, for the purposes of article 38 of the Revised M&As, to purchase Ordinary shares of a nominal value of €0.003 each in the Company from any Disposal Shareholder/s, as such term is defined in the afore-mentioned article 38 and subject to the terms, conditions and procedures laid down in article 38, and this in addition to the shares that may be acquired by the Company in terms of Resolution Q, subject always to the requirements of the Companies Act; and

(ii) To empower the Board of Directors to take any action as may be required pursuant to article 38 of the Revised M&As, including, if the Board of Directors deems fit, to cancel the same as required or permitted in terms of applicable law. (Resolution S)

28. Closing of the Annual General Meeting

Information about proposals related to specific Agenda items

Agenda item 2

The Nomination Committee, appointed by the Company pursuant to article 96 of the Articles, proposes that Anders Ström be elected the Chairperson of the Meeting.

Agenda items 9 and 10

The Company’s Annual Report and Financial Statements (both individual and consolidated) for the year ended 31 December 2024 are available on the Company’s website.

Agenda item 12

The Nomination Committee proposes that the aggregate amount per annum of the total remuneration of Directors shall not exceed €487,000, (previously €380,000).

The Directors have determined in terms of articles 73 and 74 of the Articles that the annual amount of the ordinary remuneration of a Director shall be €55,125 (previously €55,125) and that the annual amount of the ordinary remuneration of the Chairperson of the Board shall be €110,250 (previously €110,250). In addition, the annual remuneration payable to each member of the Audit Committee, the Remuneration Committee and the Strategy Committee shall be €7,350 (previously €7,350). The annual remuneration payable to the Chairperson of the Audit Committee shall be 25% (previously 25%) in excess of the remuneration payable to each member of the Audit Committee for a total of €9,188.

Additionally, the Directors have determined that an extra fee of €2,100 (previously €2,100) is payable to each Director per licence application handled in the US, and a fee at the rate of €2,205 (previously €2,205) per day spent in the US in conjunction with handling of the applications, is paid to any Director as required.

Agenda items 13-19

CVs for the current Directors are to be found on pages 43-44 in the Kambi Group plc Annual Report for 2024 and on the Company’s website. Below is a brief CV for the proposed new Directors:

Anna Nordell Westling is a Swedish citizen, born 1979

Anna Nordell Westling is an entrepreneur, independent investor and advisor, specialized in brand development, business building, operational growth, applied AI, innovation, marketing, and consumer insight to support company growth and competitiveness. She is the co-founder of Sana Labs, where she was active from the start 2016 to 2023. Nordell Westling has previous experience developing and executing marketing strategies at Saatchi & Saatchi, Acne, and King. She serves on the investment committee of SSE Ventures and acts as an advisor to Tendium, Redpine AI and Anch AI.

Nordell Westling holds a BA in Science, Marketing & Art History from San José State University, CA. In 2024 she studied AI Business Strategy at the MIT.

Anna Nordell Westling holds no current or previous position within, or relationship with, the Group or any of its affiliates. She is thus deemed to be independent from the Group.

Ronnie Bodinger is a Swedish citizen, born 1973

Bodinger is an independent senior IT consultant with over 20 years of experience in executive technical and business advisory roles. He is working with Ascot Lloyd of United Kingdom and has had assignments by among others from Nordic Capital, Nordax Bank, and Trustly Group on M&A activities, portfolio company strategy, technological transformation and IT-restructuring. Bodinger is a Member of the Board of Directors of Lysa, and he has had assignments as CTO of Builthouse of Germany and of Nordnet Bank and CIO of MTG and of Avanza Bank.

Bodinger holds an MSc-degree in Electrical Engineering from the KTH Royal Institute of Technology of Stockholm.

Ronnie Bodinger holds no current or previous position within, or relationship with, the Group or any of its affiliates. He is thus deemed to be independent from the Group.

Agenda item 21

The Nomination Committee proposes that the Annual General Meeting resolves that, until a general meeting of the shareholders decides otherwise, the Nomination Committee shall consist of not less than four and not more than five members, of which one shall be the Chair of the Board of Directors. The members of the Nomination Committee represent all shareholders and are appointed by the three or four largest shareholders as of 30 September each year, having expressed their willingness to participate in the Committee.

Agenda item 22

The Nomination Committee, based on a recommendation from the Audit Committee, proposes to re-appoint Mazars as auditors of the Company and their remuneration should be based on a fixed fee negotiated by the Directors.

Agenda item 23

The objectives of the authorisation are to increase the financial flexibility of the Company and to enable the Company to use its own financial instruments for payment in kind or through a directed set-off to a selling partner in connection with any business acquisitions the Company may undertake or to settle any deferred payments in connection with business acquisitions. The market value of the shares on each issue date will be used in determining the price at which shares will be issued. For the purposes of article 88(7) of the Companies Act, through this resolution the shareholders of the Company are also authorising the Board to restrict or withdraw the right of pre-emption that would normally entitle members to be offered the newly issued shares in the Company in proportion to their shareholding before such new shares are offered to third parties.

Agenda item 24

The Board proposes the establishment of an executive share option plan (Share Option Plan 2025). This will provide continuing share incentives for key personnel of the Company (both existing and yet-to-be recruited). The scheme should provide an ongoing retention/reward horizon for participants after June 2025.

The intention of the Share Option Plan 2025 is that the awards will be given to key personnel, with the focus on providing a balanced overall remuneration package.

The options will have a 3-year vesting period. Up to 5% of issued share capital will be available for the new share option plan over a period of 5 years, with a maximum of 1.5% per year.

It is proposed that the options are issued with an exercise price range between 20%-50% above the average share price in the 10 working days prior to the issue of the options. This range will be determined by the Board prior to each grant at its discretion based upon relevant factors.

For the purposes of Article 88(7) of the Companies Act, through this resolution the members of the Company are also authorising the Board to restrict or withdraw the members’ right of pre-emption that would normally entitle members to be offered the options in proportion to their shareholding in the Company before such options can be offered to third parties.

Agenda item 25

The Board proposes that the acquisition by the Company of its own shares shall take place on First North Growth Market at Nasdaq Stockholm or via an offer to acquire the shares to all members of the Company. Such acquisitions of own shares may take place on multiple occasions and will be based on market terms, prevailing regulations and the capital situation at any given time. Notification of any purchase will be made to First North Growth Market at Nasdaq Stockholm and details will appear in the Company’s annual report and accounts. Any resolution to repurchase own shares will be publicly disclosed. The objective of the buyback and transfer right is to ensure added value for the Company’s shareholders and to give the Board increased flexibility with the Company’s capital structure.

Following such buybacks, the intention of the Board would be to either cancel the shares, use them as consideration for an acquisition or transfer them to employees under company incentive plans.

If used as consideration for an acquisition, the intention would be that they would be issued as shares and not sold first.

Agenda item 26

The primary objective of Resolution R is to introduce a new article 38 in the Articles of Association of the Company specifically regulating “Unsuitable Persons”, in order to enhance compliance with gambling laws and regulations – and reduce corresponding risk – by creating a framework that would allow the Company to respond to future issues arising from lack of compliance with regulatory requirements by shareholders.

By way of background, the Company, through different subsidiaries, currently holds around 70 corporate gambling regulatory approvals and has a strong presence in the United States (“US”), where it is licensed in multiple states and tribes. Most US jurisdictions, as well as some non-US ones, have strict regulations and stringent licensing procedures whereby, to obtain regulatory approvals, the Company has to disclose information on the business and on the individuals running it, as well as on its ultimate shareholders above a certain threshold. This is in order for the regulators to assess the suitability of those involved with the gambling enterprise.

Gambling authorities may require shareholders to apply for qualification, finding of suitability or, if they fit into the definition of institutional investor under the relevant framework, to apply for a waiver of licensure. Non-compliance with application requirements of the gambling authorities can lead to shareholders being deemed unsuitable and thus to disciplinary actions for the Company and/or its subsidiaries. Furthermore, once application requirements are fulfilled, the authorities assess suitability and, if a negative determination is made, may expect relevant shareholders to have their rights suspended and to dispose of their securities – otherwise the Company and/or its subsidiaries would be once more subject to disciplinary action. Disciplinary actions range from warning and fines to, in more extreme scenarios, licence suspension or revocation, and can have a material impact on the Company’s ability to conduct its business and therefore a material impact on its revenues and financial performance.

It should be noted that in obtaining its Nevada licence in January 2025, the Company was required, as is standard, to implement a Compliance Plan and a Compliance Committee and any unsuitability matters must be assessed/investigated and reported to the Committee. The Committee then formulates a recommendation to management regarding a course of action to appropriately address the specific situation. Currently, if the Company faces any such issue in relation to a shareholder, it has no coercive mechanism to address it – which is a gap that the proposed framework intends to close.

The main features of the proposed framework are:

- It establishes a mechanism to be triggered at the point in time in which a shareholder goes beyond a certain threshold (5%, 10%, 15%, 20%, 25%, 30% or 50%) to require the shareholder to comply with applicable regulatory and licensing requirements;

- If the shareholder fails to comply with such requirements or is found unsuitable by a gambling authority or otherwise represents a threat to the Company and/or its subsidiaries’ licensing status or acts in breach of any laws and regulations, the shareholder would be given notice of being deemed an unsuitable person and would be given no less than 7 days’ notice to voluntarily dispose of his/her shares;

- If such disposal does not happen within such period, a buyback/forced sale mechanism would be triggered, along with the restriction of certain rights attaching to such shares until the transfer is complete.

It is worth highlighting that similar frameworks are quite common in the incorporation documents of US and European gambling related companies with a strong US presence.

Other changes proposed in the Revised M&As are amendments to reflect current applicable law and best practices and/or to reflect any changes which have occurred since the Company’s Current M&As were last registered with the Malta Business Registry, including updating the Board of Directors’ clause, where and to the extent necessary, so as to reflect any changes to the Directors in office pursuant to Resolutions J and K.

Agenda item 27

The primary objective of Resolution S is to create a specific mandate for the acquisition of the Company’s own shares subject to the terms of article 38 of the Revised M&As, which is separate and distinct from the share buyback mandate contemplated under Resolution Q, and to effectively empower the Board of Directors to take any and all action as may be contemplated and/or required to be taken in terms of article 38 of the Revised M&As, and as required or permitted in terms of applicable law.

Other

The Company has 29,903,619 Ordinary shares in issue as of the date of this notice (one vote per ordinary share).

The post Notice of Kambi Group Plc Annual General Meeting 2025 appeared first on European Gaming Industry News.

Latest News

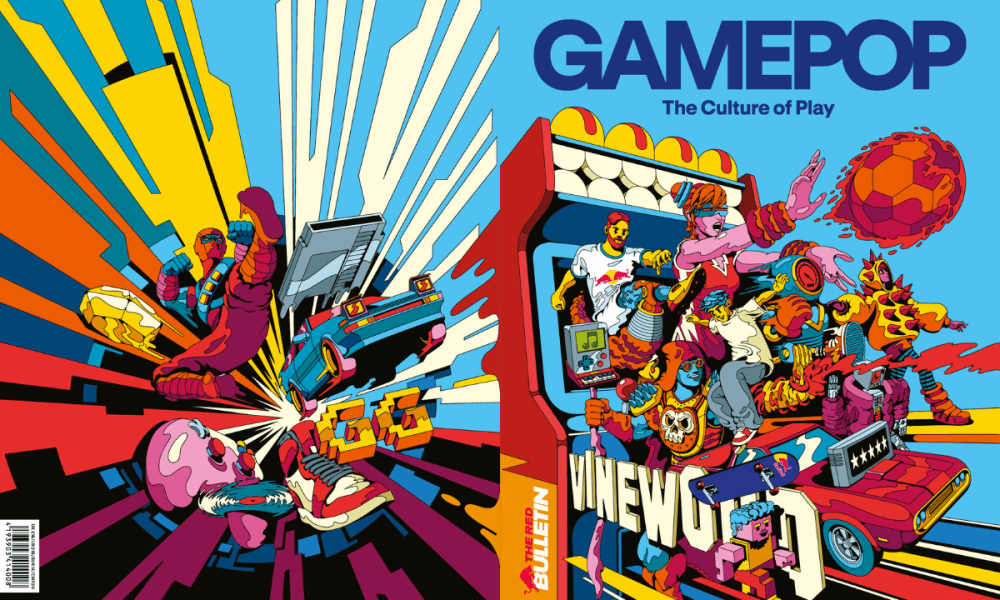

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

Latest News

White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia

Partnership sees leading branded content and popular Jackpot Royale integrated into Delaware North’s Betly online casino in the Mountain State

White Hat Studios, the “House of Brands” provider to the United States iGaming market, has partnered with Delaware North to launch on its Betly mobile sportsbook and casino in West Virginia.

The leading provider aims to build its online casino offering with the addition of the industry’s top-performing games.

Betly players in West Virginia will now have access to White Hat Studios’ acclaimed portfolio of premium branded titles, including Ted, The Goonies, and the award-winning 7s Fire Blitz series.

Also included in the rollout are the popular Jackpot Royale and Jackpot Royale Express progressive jackpot networks, currently live across more than 40 titles, and the first Betly-branded iCasino game – Betly Player’s Choice Blackjack.

Designed to elevate player engagement and boost retention, the addition of these promotional tools adds another layer of excitement to the Betly casino offering.

White Hat Studios has made significant strides in its U.S. growth trajectory since launching in 2021, consistently delivering high-performing content across multiple states. West Virginia remains a key market for the provider, following its remarkable success in all seven regulated U.S. iGaming states.

The collaboration represents another major step in White Hat Studios’ expansion across regulated U.S. states and reinforces its reputation as a go-to content partner for forward-thinking operators.

Daniel Lechner, SVP Sales and Marketing at White Hat Studios, said: “We’re thrilled to be partnering with Delaware North on the Betly online casino app in West Virginia.

“This partnership reflects our ongoing commitment to delivering top-tier content quickly and seamlessly to operators across the U.S. With our portfolio of fan-favorite branded titles and innovative features like Jackpot Royale, we’re confident we’ll make an immediate impact for Betly and its players.”

Bob Akeret, General Manager for Betly, added: “We’re excited to welcome White Hat Studios onto our Betly platform in West Virginia. Their reputation for delivering engaging, high-quality games, especially branded content, makes them an ideal partner as we continue to elevate our casino experience.”

The post White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News5 days ago

Latest News5 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login