Latest News

Sportradar Outlines Growth Strategy and Financial Outlook at Investor Day

| Provides financial targets including expectation to grow revenue at a 15% CAGR through 2027, while expanding Adjusted EBITDA margin and Free cash flow conversion by 700 basis points |

|

Sportradar Group AG (NASDAQ: SRAD) (“Sportradar” or the “Company”), the leading global sports technology company, will today host an Investor Day to present the Company’s growth strategy and financial outlook. Chief Executive Officer Carsten Koerl, Chief Financial Officer Craig Felenstein, and other members of the Sportradar leadership team will provide an in-depth look into the Company’s priorities and growth opportunities. The event will also feature a fire-side chat with Adam Silver, NBA Commissioner and Gary Bettman, NHL Commissioner, as well as presentations from Jason Robins, Co-Founder and CEO of DraftKings and George Daskalakis, Co-Founder and CEO of Kaizen Gaming, owner of the Betano sportsbook brand. Speakers will highlight Sportradar’s competitive advantages and the key elements of its growth strategy, which will enable it to continue driving significant value for partners, clients and shareholders, including:

Sportradar expects to deliver exceptional financial performance over the next three years translating to the following 2027 targets:

1 Non-IFRS measure; see the section below captioned “Non-IFRS Financial Measures” for more details. Carsten Koerl, Sportradar Chief Executive Officer, said: “We look forward to sharing our vision and strategy for driving sustainable, long-term growth at our Investor Day. As the market leader in sports technology, Sportradar is uniquely positioned at the center of the sports ecosystem. With our leading scale, unparalleled global distribution network and history of innovation we are confident in our ability to continue our strong momentum and deliver tremendous value for our clients, partners and shareholders.” The full agenda and a live stream of the presentations, beginning at 9 am EST, can be found on the Sportradar Investor Relations website and dedicated Investor Day website. A replay will be available after the event concludes.

Non-IFRS Financial Measures We have provided in this press release financial information that has not been prepared in accordance with IFRS, including Adjusted EBITDA, Adjusted EBITDA margin, Free cash flow, and Free cash flow conversion. We use these non-IFRS financial measures internally in analyzing our financial results and believe they are useful to investors, as a supplement to IFRS measures, in evaluating our ongoing operational performance. We believe that the use of these non-IFRS financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-IFRS financial measures to investors. Non-IFRS financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with IFRS.

License fees relating to sport rights are a key component of how we generate revenue and one of our main operating expenses. Only licenses that meet the recognition criteria of IAS 38 are capitalized. The primary distinction for whether a license is capitalized or not capitalized is the contracted length of the applicable license. Therefore, the type of license we enter into can have a significant impact on our results of operations depending on whether we are able to capitalize the relevant license. As such, our presentation of Adjusted EBITDA reflects the full costs of our sport right’s licenses. Management believes that, by including amortization of sport rights in its calculation of Adjusted EBITDA, the result is a financial metric that is both more meaningful and comparable for management and our investors while also being more indicative of our ongoing operating performance. We present Adjusted EBITDA because management believes that some items excluded are non-recurring in nature and this information is relevant in evaluating the results relative to other entities that operate in the same industry. Management believes Adjusted EBITDA is useful to investors for evaluating Sportradar’s operating performance against competitors, which commonly disclose similar performance measures. However, Sportradar’s calculation of Adjusted EBITDA may not be comparable to other similarly titled performance measures of other companies. Adjusted EBITDA is not intended to be a substitute for any IFRS financial measure. Items excluded from Adjusted EBITDA include significant components in understanding and assessing financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation, or as an alternative to, or a substitute for, profit for the period, revenue or other financial statement data presented in our consolidated financial statements as indicators of financial performance. We compensate for these limitations by relying primarily on our IFRS results and using Adjusted EBITDA only as a supplemental measure.

The Company is unable to provide a reconciliation of Adjusted EBITDA to profit (loss) for the period or Adjusted EBITDA margin to profit (loss) for the period as a percentage of revenue (in each case the most directly comparable IFRS financial measure), on a forward-looking basis without unreasonable effort because items that impact this IFRS financial measure are not within the Company’s control and/or cannot be reasonably predicted. These items may include, but are not limited to, foreign exchange gains and losses. Such information may have a significant, and potentially unpredictable, impact on the Company’s future financial results. We consider Free cash flow and Free cash flow conversion to be liquidity measures that provide useful information to management and investors about the amount of cash generated by the business after the purchase of property and equipment, the purchase of intangible assets and payment of lease liabilities, which can then be used, among other things, to invest in our business and make strategic acquisitions, as well as our ability to convert our earnings to cash. A limitation of the utility of Free cash flow and Free cash flow conversion as measures of liquidity is that they do not represent the total increase or decrease in our cash balance for the year.

The Company is unable to provide a reconciliation of Free cash flow to net cash from operating activities or Free cash flow conversion to net cash from operating activities as a percentage of profit for the period from continuing operations (in each case the most directly comparable IFRS financial measure), on a forward-looking basis without unreasonable effort because items that impact this IFRS financial measure are not within the Company’s control and/or cannot be reasonably predicted. These items may include, but are not limited to, changes in working capital, the timing of customer payments, the timing and amount of tax payments, and other non-recurring or unusual items. Such information may have a significant, and potentially unpredictable, impact on the Company’s future financial results. Safe Harbor for Forward-Looking Statements Certain statements in this presentation may constitute “forward-looking” statements and information within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 that relate to our current expectations and views of future events, including, without limitation, statements regarding future financial or operating performance, planned activities and objectives, anticipated growth resulting therefrom, market opportunities, strategies and other expectations, and our guidance and outlook, including targets for 2027 performance. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “projects”, “continue,” “contemplate,” “confident,” “possible” or similar words. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the following: economy downturns and political and market conditions beyond our control, including the impact of the Russia/Ukraine and other military conflicts such as acts or war or terrorism and foreign exchange rate fluctuations; pandemics could have an adverse effect on our business; dependence on our strategic relationships with our sports league partners; effect of social responsibility concerns and public opinion on responsible gaming requirements on our reputation; potential adverse changes in public and consumer tastes and preferences and industry trends; potential changes in competitive landscape, including new market entrants or disintermediation; potential inability to anticipate and adopt new technology, including efficiencies achieved through the use of artificial intelligence; potential errors, failures or bugs in our products; inability to protect our systems and data from continually evolving cybersecurity risks, security breaches or other technological risks; potential interruptions and failures in our systems or infrastructure; difficulties in our ability to evaluate, complete and integrate acquisitions (including the IMG ARENA acquisition) successfully; our ability to comply with governmental laws, rules, regulations, and other legal obligations, related to data privacy, protection and security; ability to comply with the variety of unsettled and developing U.S. and foreign laws on sports betting; dependence on jurisdictions with uncertain regulatory frameworks for our revenue; changes in the legal and regulatory status of real money gambling and betting legislation on us and our customers; our inability to maintain or obtain regulatory compliance in the jurisdictions in which we conduct our business; our ability to obtain, maintain, protect, enforce and defend our intellectual property rights; our ability to obtain and maintain sufficient data rights from major sports leagues, including exclusive rights; any material weaknesses identified in our internal control over financial reporting; inability to secure additional financing in a timely manner, or at all, to meet our long-term future capital needs; and other risk factors set forth in the section titled “Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2024, and other documents filed with or furnished to the SEC, accessible on the SEC’s website at sec.gov and on our website at investors.sportradar.com. These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this press release. One should not put undue reliance on any forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

|

The post Sportradar Outlines Growth Strategy and Financial Outlook at Investor Day appeared first on European Gaming Industry News.

Latest News

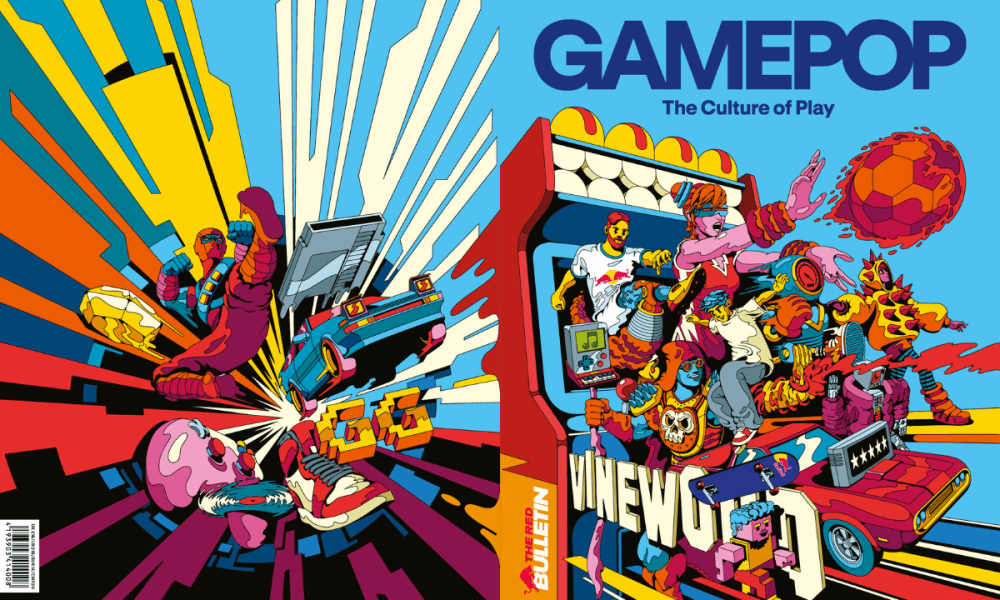

GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture

Introducing GAMEPOP: The Culture of Play, a new premium bookazine by Red Bull Media House and the world’s first magazine dedicated entirely to video-game culture. Designed as a rich, book-like publication, GAMEPOP rethinks what a magazine can be, capturing the creativity, personalities and ideas shaping modern gaming. GAMEPOP will debut at the Red Bull Tetris World Final in Dubai from December 11 to 13, followed by The Game Awards on December 11. The issue will then be available through select international retailers in the weeks that follow.

Across 180 pages, the issue brings together a wide range of cultural voices, including Japanese game designer Hideo Kojima, leading DC Comics creators, the Oscar-nominated team behind Grand Theft Hamlet and contributors with bylines in Vogue. The bookazine also spotlights standout Red Bull talent, including YouTube star Ludwig, Twitch creators Emiru and Caedrel, and Red Bull athlete MenaRD.

Rather than treating gaming as a standalone medium, GAMEPOP looks at how games influence, and are influenced by, wider culture. Through original photography, long-form features, illustration and visual essays, the publication explores how gaming connects to global trends in style, music, movement, storytelling and performance, and the creative communities driving that conversation.

The issue also includes interactive elements, including a bespoke Choose Your Own Adventure story created exclusively for the launch. A limited collector edition of 150 copies takes the concept a step further, featuring a fully functioning Tetris® device embedded directly into the cover – an industry first that turns the magazine into an object of play.

The post GAMEPOP: The Culture of Play by Red Bull Media House – the first bookazine devoted entirely to video game culture appeared first on Gaming and Gambling Industry Newsroom.

Latest News

Red Rake Gaming Expands Global Presence Through Partnership with QTech Games

Red Rake Gaming is pleased to announce a partnership with QTech Games, a leading aggregator and platform renowned for its strong presence in emerging markets on a global level. This collaboration brings Red Rake’s diverse and visually engaging portfolio of slots to QTech Games’ extensive aggregation platform, giving players across multiple continents access to high-quality, entertainment-focused casino content.

Founded in 2015, QTech Games is celebrating its 10-year anniversary in 2025. Over the past decade, the company has grown from rapid early-stage expansion to become a dominant force into emerging markets worldwide. With a global presence —including a new tech hub in Spain and offices in Malta—and Latin America, QTech Games has established itself as a fully-fledged international powerhouse.

Players can now enjoy titles from the Million Series, the Super Stars Series, and seasonal slots such as Halloween Wins and Christmas Wins, alongside new adventures including Azteca Gold Collect, Sherlock and the Stolen Gems, Beating Alcatraz, Big Size Fishin’, and Midas Wins.

QTech Games CEO, Philip Doftvik, said: “It’s another notch on our belt to have integrated more premium content from Red Rake. Theirs is a growing and constantly innovating library, delivering impressive support to the depth of our broad igaming-vertical spread.”

Nick Barr, Managing Director for Red Rake Gaming Malta, commented: “We are thrilled to partner with QTech Games and bring our portfolio of games to their growing network. Their leadership in emerging markets and innovative approach to aggregation allow us to reach new players and provide them with high-quality gaming experiences featuring unique features and visually engaging content. This collaboration marks an important step in strengthening our presence in key markets and further establishing Red Rake Gaming’s international presence.”

The post Red Rake Gaming Expands Global Presence Through Partnership with QTech Games appeared first on Gaming and Gambling Industry Newsroom.

Latest News

White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia

Partnership sees leading branded content and popular Jackpot Royale integrated into Delaware North’s Betly online casino in the Mountain State

White Hat Studios, the “House of Brands” provider to the United States iGaming market, has partnered with Delaware North to launch on its Betly mobile sportsbook and casino in West Virginia.

The leading provider aims to build its online casino offering with the addition of the industry’s top-performing games.

Betly players in West Virginia will now have access to White Hat Studios’ acclaimed portfolio of premium branded titles, including Ted, The Goonies, and the award-winning 7s Fire Blitz series.

Also included in the rollout are the popular Jackpot Royale and Jackpot Royale Express progressive jackpot networks, currently live across more than 40 titles, and the first Betly-branded iCasino game – Betly Player’s Choice Blackjack.

Designed to elevate player engagement and boost retention, the addition of these promotional tools adds another layer of excitement to the Betly casino offering.

White Hat Studios has made significant strides in its U.S. growth trajectory since launching in 2021, consistently delivering high-performing content across multiple states. West Virginia remains a key market for the provider, following its remarkable success in all seven regulated U.S. iGaming states.

The collaboration represents another major step in White Hat Studios’ expansion across regulated U.S. states and reinforces its reputation as a go-to content partner for forward-thinking operators.

Daniel Lechner, SVP Sales and Marketing at White Hat Studios, said: “We’re thrilled to be partnering with Delaware North on the Betly online casino app in West Virginia.

“This partnership reflects our ongoing commitment to delivering top-tier content quickly and seamlessly to operators across the U.S. With our portfolio of fan-favorite branded titles and innovative features like Jackpot Royale, we’re confident we’ll make an immediate impact for Betly and its players.”

Bob Akeret, General Manager for Betly, added: “We’re excited to welcome White Hat Studios onto our Betly platform in West Virginia. Their reputation for delivering engaging, high-quality games, especially branded content, makes them an ideal partner as we continue to elevate our casino experience.”

The post White Hat Studios launches with Betly mobile sportsbook and casino in West Virginia appeared first on Gaming and Gambling Industry Newsroom.

-

Latest News3 months ago

Announcement: 25th September 2025

-

Latest News3 months ago

AI-Powered Gamification Arrives on Vegangster Platform via Smartico

-

Latest News1 month ago

JioBLAST Launches All Stars vs India powered by Campa Energy: A New Era of Creator-Driven Esports Entertainment

-

Latest News5 days ago

Latest News5 days agoSCCG Announces Strategic Partnership with Yellow Elephant Studios to Expand Multi-Channel Gaming Content Worldwide

-

Latest News3 months ago

The Countdown is On: Less Than 3 Months to Go Until The Games of The Future 2025 Kicks Off in Abu Dhabi

-

eSports1 month ago

CS:GO Betting Gains Momentum in the iGaming Sector

-

Latest News2 weeks ago

THE 2025 PUBG MOBILE GLOBAL CHAMPIONSHIP GROUP STAGE WRAPS UP WITH LAST CHANCE IN SIGHT

-

Latest News3 months ago

Leading The Charge! Euronics Group Joins LEC As Official Electronics Retail Partner

You must be logged in to post a comment Login